‘Mammi, Papa, increase my pocket money, please? - said every one of us throughout our childhood.

Simply because we had so many new things to try and do, starting from our first ever mall-visit to eating at new

places, birthday parties, graduation parties, parties for no particular reason, dates, etc. And as we grew up, we

kept needing more and more money from our parents until the time we started earning our own money via day jobs and

businesses.

But very few of us, ever actually saved from those times that we got pocket money. Most of us would spend 100% of it

and ask for more. Only a handful examples are there where we see the ‘smart’ people having saved a part of their

pocket money to benefit them in some way. We hear about kids these days who come as brilliant examples of what we

could have achieved at that age if we knew the idea of growing money! We sometimes even regret not having enough

financial knowledge.

If you notice even today, our kids need pocket money. But we can also help them with financial literacy, right? So

that they learn about the concepts of saving money, growing money, investing money in ways we never learnt. We can

teach them about bad debts and how to care for money so that when they grow up, they grow up to be financially

independent youngsters who perhaps can even fund their tuition fees and vocational courses with their own saved

money.

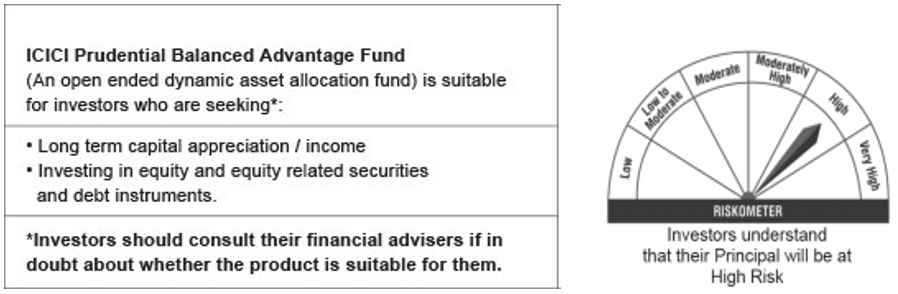

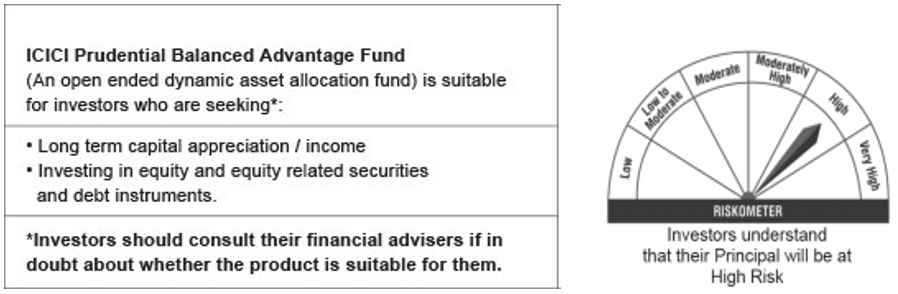

This is where we would like to introduce to you our product called - ICICI Prudential Balanced Advantage Fund. This

scheme allows your money to be tactfully utilized based on market fluctuations so that your risk can be managed and

potential returns can be gained.

Fund managers play a huge role in handling this scheme by bringing the benefits of an expert’s eye to understand and

analyse the market conditions before investing your money in stocks and bonds. We often get emotional with our money

due to reasons of ownership and confidence. It is hence better to leave the job of growing your money to people who

have expert teams and years of experience in handling and growing money based on your objectives.

Let’s see how ICICI Prudential Balanced Advantage Fund (BAF) can help your children to attain financial

independence.

The 1, 2, 3 and 4 of ICICI Prudential Balanced Advantage Fund:

1. The A in BAF stands for Advantage. It means that with this scheme, you can invest in both worlds - Equity and

Debt as per the market situations.

2. The B in BAF stands for Balanced. Our fund managers wisely balance your portfolio in this scheme by investing in

Debt when the market goes up and in Equity when the market falls.

3. BAF aims to reduce and limit the losses even when the market goes down.

4. The Scheme invests in companies across different sectors.

It goes without saying that we also want the best for our children. This Children’s Day, take your first step by

providing them financial knowledge and by investing in ICICI Prudential Balanced Advantage Fund for your children’s

future and give them the gift of financial freedom!

Start investing today, for your children’s better future, tomorrow

Please note that the Risk-o-meter specified above will be evaluated and updated on a monthly basis. The above

riskometer is as on October 31, 2022.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

![]()

![]()

![]()

![]()