How to aim towards financial fitness with ICICI Prudential Balanced Advantage Fund?

Just like maintaining a physically fit lifestyle, it is essential to assess the fitness of our financial lives in

order to live a life that is financially secure and stress-free. With ICICI Prudential Balanced Advantage Fund, you

can manage your financial situation and aim to be financially fit. Commonly, when markets go up you would feel

excellent about your equity investments and when they go down you would start stressing about them. A falling market

and the dread of potential losses see them heading toward the exit door. The reality is that there will always be

short-term downsides to investment. There is no mode of avoiding it, but there are several ways of limiting it. And

one such manner of limiting downsides is investing in an ICICI Prudential Balanced Advantage Fund.

What is ICICI Prudential Balanced Advantage Fund?

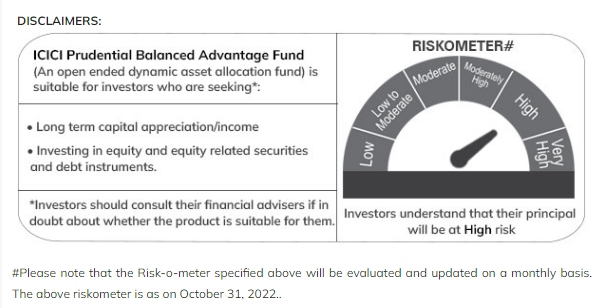

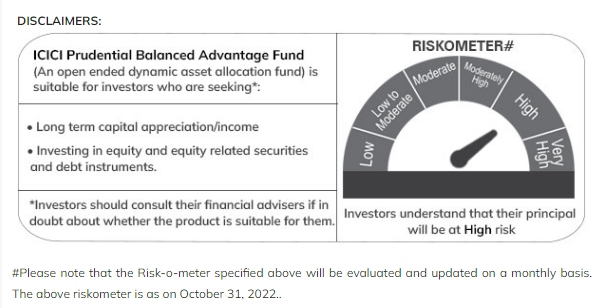

ICICI Prudential Balanced Advantage Fund is a hybrid scheme that invests in both equity and debt based on the market

situation in accordance with SID provisions. Therefore, by investing in this scheme investors do not have to keep a

constant eye on the changing market behaviour or worry about their invested amount.

Here is a simple & step-by-step guide on how to start investing in ICICI Prudential Balanced Advantage Fund,

Step 1: Identify Your Fitness Objectives

This scheme could be a good choice if you're seeking to achieve your long-term goals.

Step 2: Eat Healthy + Work-out Well

Just like your body needs the right balance of nutrition while working out, your portfolio needs a balance of equity

for wealth creation and debt for overall stability

Step 3: Don't Break The Fitness Routine

Maintaining a healthy lifestyle is crucial to stay fit, similarly, you should stay invested for a longer period to

attain financial fitness!

This scheme aims to help you to ride the equity wave while maintaining a stable portfolio. The investment is

distributed in equity shares and debt instruments in a specific percentage according to the investment mandate of

the scheme. Instead of risking all your capital in equity, the scheme helps you invest prudently.

Why You Should Invest?>

● Equity for Growth

This scheme invests predominantly in stocks and other equity-related instruments with a potential to grow with

long-term capital appreciation. This leads to greater wealth generation and investment in equities, which also

allows you to tackle current inflation.

● Debt for Managing Volatility

A fund manager reduces exposure from equity and increases exposure to debt when equity valuation is high.

● Diversified Portfolio

This is an open-ended scheme for income distributions and capital gains. The dynamic rearrangement of assets between

fixed income and equity lets you diversify your portfolio. With a well-diversified portfolio of securities, ICICI

Prudential Balanced Advantage Fund can offer better risk-adjusted returns.

Many people regret not starting investing early. By gaining the knowledge and skills one can develop long-term

wealth.

Investing in ICICI Prudential Balanced Advantage Fund has the potential to help you become financially fit and give

you a sense of comfort when it comes to money. This will ultimately reduce your worries and anxiety when it comes to

financial concerns and life’s unexpected turns. The scheme aims to find the right opportunities for the investor in

any market cycle. It takes care of asset allocation, which is the greatest benefit for those who probably don’t have

the time or resources to study the market and the investment opportunities.

Mutual fund investments are

subject to

market risks, read all scheme related documents carefully.

![]()

![]()

![]()

![]()

-(002)798d.jpg?sfvrsn=71bec84_0)