Author:

Executive Director and CIO, ICICI Prudential Mutual Fund- Sankaran Naren

After allowing nearly zero interest rates and easy liquidity for an extended period of time since 2008, central

banks in the majority of developed countries began to tighten their belts as inflation began to hurt starting in

November 2021. Previously, the easy access to capital meant that equity inflows continued unabatedly, resulting in a

significant market rally over the previous decade or so. The Russia-Ukraine conflict has also worsened the situation

and caused an energy crisis, apart from adding to global inflation.

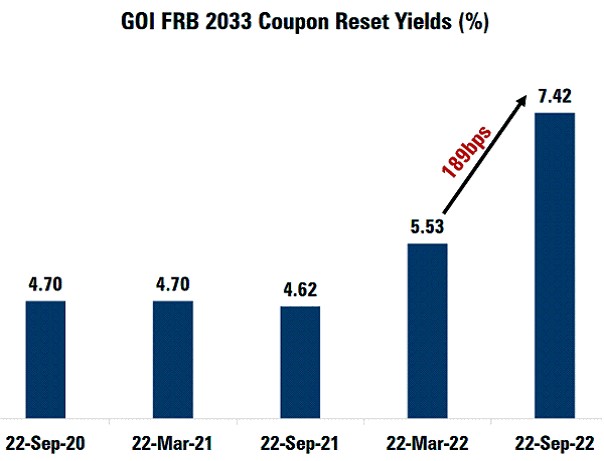

As a result, the US Federal Reserve and many of the developed market central banks began raising rates, and

concurrently, the Reserve Bank of India (RBI) raised its repo rate by 190 basis points from May of this year to 5.9%

at the present time as a result of a sharp increase in inflation in India.

Despite a year of flat returns, the Indian equity markets have been among the most expensively valued markets in the

world. Since market valuations are not low, it is prudent to be aware of the risks even though the Indian Central

Bank, Indian government, and corporates have all handled the situation very well so far. Although equity markets

continue to be volatile, India is still one of the most structural markets in the world, so we need not be overly

concerned.

Debt funds look appealing right now because of their higher yields provided by the environment's high inflation and

rising interest rates. As a result, now might be a good time for investors to think about investing in debt funds

because their prospects seem promising. Against this reality, this article sheds light on how you can make the most

of your debt funds.

Firstly, high interest rates are here to stay…

Before reflecting on how debt funds can be used at this time, let’s note some factors that suggest that elevated

inflation and interest rates may persist at least for the next few years.

Inflation uncomfortable: The RBI's tolerance band of 2-6% inflation rate has been exceeded due to the CPI being over

7% and the WPI consistently reporting double-digit inflation rates.

Twin deficits remain high: India's fiscal and current account deficits are both still substantial. Given that India

imports the majority of its oil needs, these deficits are likely to remain elevated.

Credit growth more than deposit growth: After many years, there is a scenario where credit growth in the financial

system (greater than 15%) is higher than deposit growth, which indicates the possibility that higher rates would

persist.

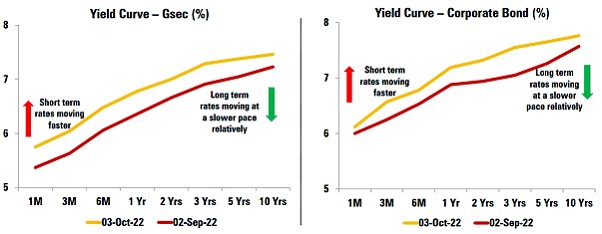

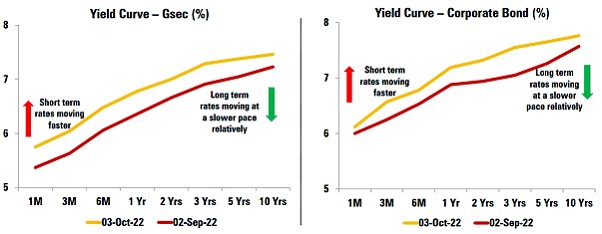

Yield curve position lacklustre: The yield on the 10-year g-sec has increased only 57 basis points from March to

September of this year, whereas the yield on the 1-year g-sec increased by 242 basis points. However, this situation

may change in the future.

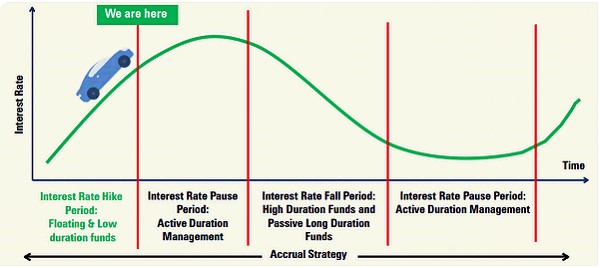

…and how debt funds can play the rising rate cycle

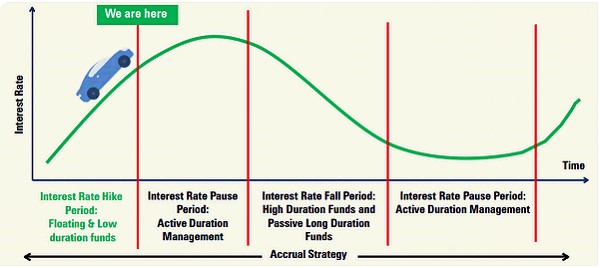

The RBI will perhaps increase rates, given the persistent inflation and challenging global economic environment. In

this scenario of rising rates, you can use a few strategies mentioned below to make the most out of your debt funds.

A combination of these steps and a focus on active duration management may lead to better payoffs yet for

investors:

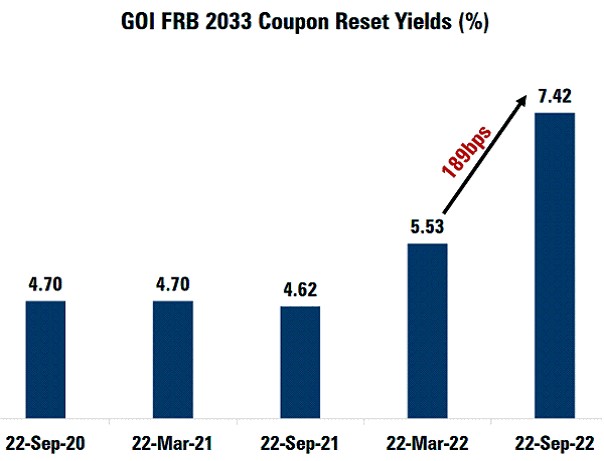

(1) Invest in funds with floating-rate bonds and instruments Floating rate bonds would benefit from any increase in

interest rates, as coupons are reset periodically. This would translate into higher pay-outs for investors .

(2) Focus on low duration funds: In general, low duration funds are better positioned when interest rates are rising

and may, therefore, potentially perform better for investors.

(3) Emphasize on accrual strategy and spread assets: Spread assets or bonds with ratings of AA, AA- or lower will

have higher spreads or interest rates than AAA securities. Investor returns are likely to increase as a result of

this.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

![]()

![]()

![]()

![]()