Investment Objective

The investment objective of the scheme is

to replicate the composition of the Nifty

Smallcap 50 Index and to generate returns

that are commensurate with the

performance of the Nifty Small cap 50

Index, subject to tracking errors.

There is no assurance or guarantee that the investment objective of the scheme would be achieved. The scheme does not assure or guarantee any returns.

There is no assurance or guarantee that the investment objective of the scheme would be achieved. The scheme does not assure or guarantee any returns.

The investment objective of the scheme is

to replicate the composition of the Nifty

Smallcap 50 Index and to generate returns

that are commensurate with the

performance of the Nifty Small cap 50

Index, subject to tracking errors.

There is no assurance or guarantee that the investment objective of the scheme would be achieved. The scheme does not assure or guarantee any returns.

There is no assurance or guarantee that the investment objective of the scheme would be achieved. The scheme does not assure or guarantee any returns.

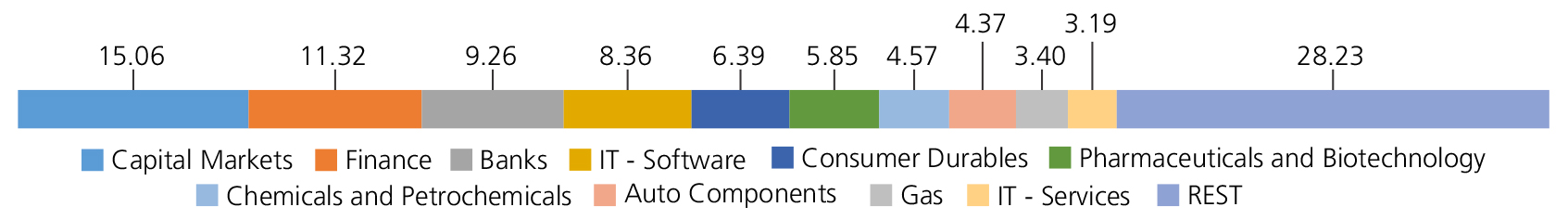

| Instrument/Industry/Issuer | |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Capital Markets | 15.06 | |

| Multi Commodity Exchange of India Limited | 3.24 | |

| Angel One Limited | 2.96 | |

| Central Depository Services (India) Ltd. | 2.88 | |

| Computer Age Management Services Limited | 2.53 | |

| Indian Energy Exchange Ltd | 1.93 | |

| Nippon Life India Asset Management Ltd. | 1.52 | |

| Finance | 11.32 | |

| IDFC Limited | 2.79 | |

| Manappuram Finance Ltd | 1.78 | |

| Five Star Business Finance Ltd | 1.59 | |

| Creditaccess Grameen Ltd. | 1.44 | |

| IIFL Finance Ltd | 1.35 | |

| PNB Housing Finance Ltd. | 1.21 | |

| Aavas Financiers Ltd. | 1.16 | |

| Banks | 9.26 | |

| RBL Bank Ltd | 2.73 | |

| Karur Vysya Bank Ltd. | 2.70 | |

| Equitas Small Finance Bank Ltd. | 1.99 | |

| City Union Bank Ltd. | 1.84 | |

| IT - Software | 8.36 | |

| Sonata Software Ltd. | 2.65 | |

| Birlasoft Ltd. | 2.29 | |

| Zensar Technolgies Ltd. | 1.30 | |

| Tanla Solutions Limited | 1.11 | |

| Happiest Minds Technologies Limited | 1.01 | |

| Consumer Durables | 6.39 | |

| Crompton Greaves Consumer Electricals Ltd | 3.26 | |

| Blue Star Ltd. | 3.13 | |

| Pharmaceuticals and Biotechnology | 5.85 | |

| Glenmark Pharmaceuticals Ltd | 2.72 | |

| Natco Pharma Ltd | 1.64 | |

| Piramal Pharma Ltd. | 1.49 | |

| Chemicals and Petrochemicals | 4.57 | |

| Aarti Industries Ltd. | 2.52 | |

| Navin Fluorine International Ltd. | 2.05 | |

| Auto Components | 4.37 | |

| Exide Industries Ltd | 2.60 | |

| Amara Raja Energy Mob Ltd. | 1.77 | |

| Gas | 3.40 | |

| Gujarat State Petronet Ltd. | 1.94 | |

| Mahanagar Gas Ltd | 1.46 | |

| IT - Services | 3.19 | |

| Cyient Ltd. | 3.19 | |

| Industrial Products | 2.75 | |

| Finolex Cables Ltd. | 1.42 | |

| Ramkrishna Forgings Ltd. | 1.33 | |

| Non - Ferrous Metals | 2.60 | |

| National Aluminium Company Ltd | 2.60 | |

| Beverages | 2.54 | |

| Radico Khaitan Ltd. | 2.54 | |

| Electrical Equipment | 2.23 | |

| Apar Industries Limited | 2.23 | |

| Construction | 2.16 | |

| NCC Limited | 2.16 | |

| Transport Services | 1.87 | |

| Great Eastern Shipping Company Ltd | 1.87 | |

| Entertainment | 1.78 | |

| PVR Inox Limited | 1.78 | |

| Petroleum Products | 1.71 | |

| Castrol (India ) Ltd. | 1.71 | |

| Healthcare Services | 1.64 | |

| Narayana Hrudayalaya Ltd. | 1.64 | |

| Paper, Forest and Jute Products | 1.62 | |

| Century Textiles & Industries Ltd. | 1.62 | |

| Telecom - Services | 1.55 | |

| Himachal Futuristic Comm Ltd | 1.55 | |

| Retailing | 1.50 | |

| Indiamart Intermesh Ltd. | 1.50 | |

| Power | 1.44 | |

| CESC LTD | 1.44 | |

| Textiles and Apparels | 1.14 | |

| Raymond Limited | 1.14 | |

| Telecom - Equipment and Accessorie | 0.93 | |

| Tejas Networks Ltd | 0.93 | |

| Equity & Equity related - Total | 99.23 | |

| Triparty Repo | 0.20 | |

| Net Current Assets/(Liabilities) | 0.57 | |

| Grand Total | 100.00 | |

Net Asset Value (NAV)

| Regular | Direct | |

| Growth | Rs16.3040 | Rs16.4050 |

| IDCW | Rs16.3040 | Rs16.4140 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Growth, Payout of Income

Distribution cum capital withdrawal (IDCW)

& Reinvestment of Income Distribution cum

capital withdrawal (IDCW)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | Nifty Smallcap 50 Index TRI |

| Allotment date | April 10, 2023 |

| AAUM | Rs50.02 crs |

| AUM | Rs49.55 crs |

| Folio count | 11,642 |

Ratios

| Portfolio Turnover | 152.17% |

| Tracking Error | 0.74% |

Minimum Investment Amount

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

IDCW Frequency

Trustee's Discretion

Load Structure

Entry Load:

Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

| Regular Plan: | 1.04% |

| Direct Plan: | 0.40% |

Data as on 31st March, 2024 unless

otherwise specified.

Fund

Benchmark

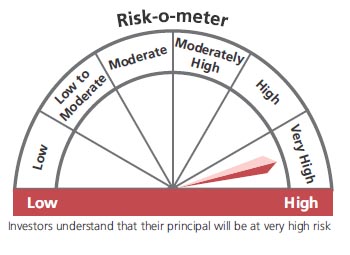

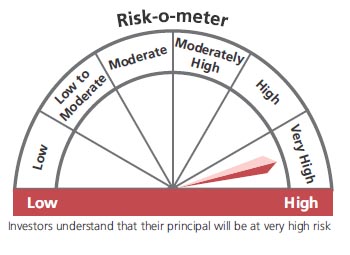

This product is suitable for investors who are seeking*:

- Long term capital appreciation

- Investment stocks comrising the underlying index and endeavours to track the benchmark index, subject to tracking errors

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2024. An addendum may be issued or updated on the website for new riskometer.

*For Fund Manager experience, please refer 'Our Fund Managers'

Total Expense Ratio includes applicable B30 fee and GST

Scheme has not completed 6 months since inception