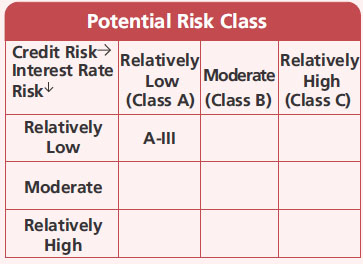

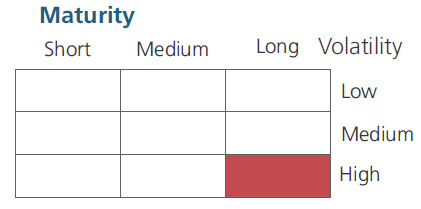

An open-ended debt scheme investing in instruments such that the Macaulay duration of the portfolio is greater than 7 Years. A relatively high interest rate risk and relatively low credit risk.

An open-ended debt scheme investing in instruments such that the Macaulay duration of the portfolio is greater than 7 Years. A relatively high interest rate risk and relatively low credit risk.

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

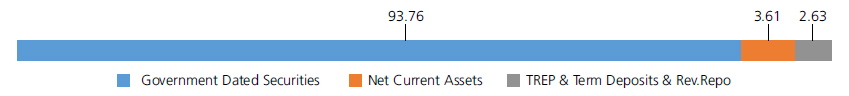

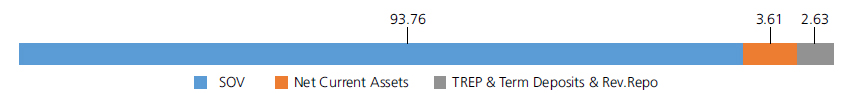

| Government Dated Securities | ||

| 7.30% Central Government | SOV | 71.67 |

| 7.18% Central Government | SOV | 22.09 |

| Government Dated Securities - Total | 93.76 | |

| Triparty Repo | 2.63 | |

| Net Current Assets/(Liabilities) | 3.61 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs10.0328 | Rs10.0340 |

| IDCW | Rs10.0328 | Rs10.0340 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout

and Reinvestment)

| Fund Manager*^ | Mr. Abhishek Bisen |

| Benchmark | Nifty Long Duration Debt Index- A-III - effective upto March 31, 2024 CRISIL Long Duration Debt A-III Index - Effective from April 1, 2024 |

| Allotment date | March 11, 2024 |

| AAUM | Rs67.73 crs |

| AUM | Rs68.43 crs |

| Folio count | 7,114 |

Trustee's Discretion

| Average Maturity | 23.83 yrs |

| Modified Duration | 10.41 yrs |

| Macaulay Duration | 10.78 yrs |

| Annualised YTM* | 7.23% |

Source: $ICRA MFI Explorer.

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 2-3 years

Entry Load:

Nil. (applicable for all plans)

Exit Load: Nil

No exit load will be chargeable in case of

switches made between different

plans/options of the scheme.

| Regular Plan: | 0.59% |

| Direct Plan: | 0.34% |

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Long term wealth creation

- To generate income / capital appreciation through investments in debt and money market instruments.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST

The Scheme has not completed 6 months.

* For Fund Manager experience, please refer 'Our Fund Managers'