Investment Objective

The investment objective of the scheme is to replicate the composition of the NIFTY MNC Index and to generate

returns that are commensurate with the performance of the NIFTY MNC Index, subject to tracking errors. However, there is no assurance or

guarantee that the investment objective of the scheme will be achieved.

The investment objective of the scheme is to replicate the composition of the NIFTY MNC Index and to generate

returns that are commensurate with the performance of the NIFTY MNC Index, subject to tracking errors. However, there is no assurance or

guarantee that the investment objective of the scheme will be achieved.

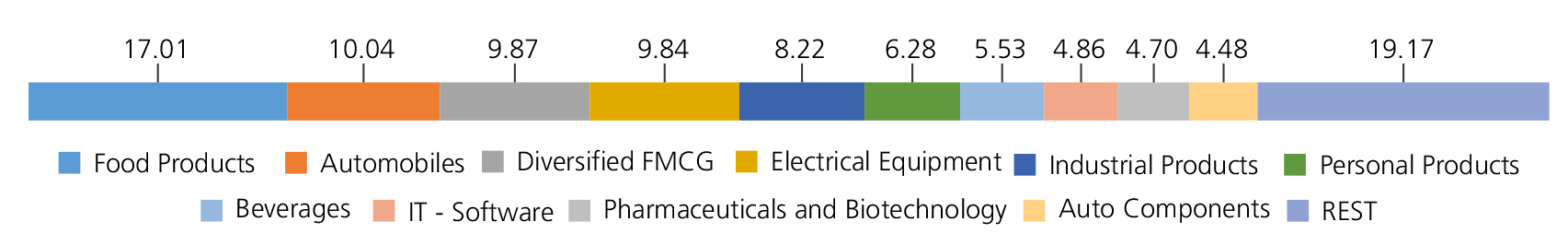

| Instrument/Industry/ Issuer |

|

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Food Products | 17.01 | |

| Nestle India Ltd. | 10.02 | |

| Britannia Industries Ltd. | 6.99 | |

| Automobiles | 10.04 | |

| Maruti Suzuki India Limited | 10.04 | |

| Diversified FMCG | 9.87 | |

| Hindustan Unilever Ltd. | 9.87 | |

| Electrical Equipment | 9.84 | |

| Siemens Ltd. | 5.77 | |

| ABB India Ltd | 4.07 | |

| Industrial Products | 8.22 | |

| Cummins India Ltd. | 4.92 | |

| SKF India Ltd | 1.17 | |

| Grindwell Norton Ltd. | 1.07 | |

| Timken India Ltd. | 1.06 | |

| Personal Products | 6.28 | |

| Colgate Palmolive (India ) Ltd. | 4.36 | |

| Procter & Gamble Hygiene and Health Care Ltd. | 1.92 | |

| Beverages | 5.53 | |

| United Spirits Ltd. | 3.98 | |

| United Breweries Ltd. | 1.55 | |

| IT - Software | 4.86 | |

| Oracle Financial Services Software Ltd | 2.47 | |

| Mphasis Ltd | 2.39 | |

| Pharmaceuticals and Biotechnology | 4.70 | |

| Abbott India Ltd. | 1.74 | |

| Gland Pharma Limited | 1.54 | |

| JB Chemicals & Pharmaceuticals Ltd. | 1.42 | |

| Auto Components | 4.48 | |

| Bosch Ltd. | 3.10 | |

| Schaeffler India Ltd | 1.38 | |

| Cement and Cement Products | 4.40 | |

| Ambuja Cements Ltd. | 4.40 | |

| Diversified Metals | 4.38 | |

| Vedanta Ltd. | 4.38 | |

| Agricultural, Commercial and Construction Vehicles | 4.08 | |

| Ashok Leyland Ltd. | 2.97 | |

| Escorts Ltd. | 1.11 | |

| Chemicals and Petrochemicals | 1.65 | |

| Linde India Ltd. | 1.65 | |

| Finance | 1.48 | |

| CRISIL Ltd. | 1.48 | |

| Diversified | 1.07 | |

| 3M India Ltd. | 1.07 | |

| Consumer Durables | 1.06 | |

| Bata India Ltd. | 1.06 | |

| Industrial Manufacturing | 1.04 | |

| Honeywell Automation India Ltd. | 1.04 | |

| Equity & Equity related - Total | 99.99 | |

| Net Current Assets/(Liabilities) | 0.01 | |

| Grand Total | 100.00 | |

Net Asset Value (NAV)

| Regular | |

| IDCW | Rs26.0961 |

Available Plans/Options

The Scheme does not offer any Plans/Options for investment.

| Fund Manager* | Mr. Devender Singhal Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | NIFTY MNC Index TRI |

| Allotment date | August 05, 2022 |

| AAUM | Rs15.54 crs |

| AUM | Rs16.06 crs |

| Folio count | 2,101 |

Ratios

| Portfolio Turnover : | 91.40% |

| Tracking Error: | 0.04% |

Minimum Investment Amount

Through Exchange: 1 Unit,

Through AMC: 150000 Units and in

multiple thereof.

Greater than Rs. 25 Crore- For Large

Investors***

Ideal Investments Horizon

• 5 years & above

Load Structure

Entry Load:

Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

| Regular Plan: | 0.30% |

Data as on 31st March, 2024 unless

otherwise specified.

Fund

Benchmark

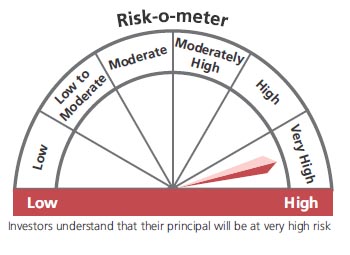

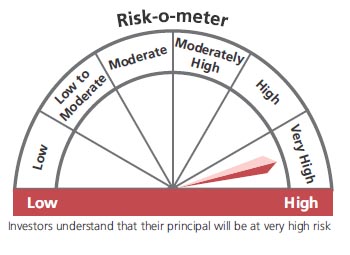

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in stocks comprising the underlying index and endeavours to track the benchmark index, subject to tracking errors.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2024. An addendum may be issued or updated on the website for new riskometer.

***Not applicable to Recognised Provident Funds, approved gratuity funds and approved superannuation funds under Income tax act, 1961, Schemes managed by Employee Provident Fund Organisation, India and Market Makers' as per SEBI circular no. SEBI/HO/IMD/DOF2/P/CIR/2022/69 dated May 23,2022 and as amended from time to time & SEBI letter no. SEBI/HOIMD/IMD-PoD-2/P/OW/2023/176441 dated April 28,2023.

* For Fund Manager experience, please refer 'Our Fund Managers'

**Total Expense Ratio includes applicable B30 fee and GST.

For scheme performance, please refer 'Scheme Performances'