An open ended fund of fund investing in units of Wellington Global Innovation Fund or any other similar overseas mutual fund schemes/ETFs

An open ended fund of fund investing in units of Wellington Global Innovation Fund or any other similar overseas mutual fund schemes/ETFs

The Scheme may, at the discretion of the Investment Manager, also invest in the units/ shares of any other similar overseas mutual fund schemes/ETFs.

It shall be noted 'similar overseas mutual fund schemes/ETFs' shall have investment objective, investment strategy, asset allocation and risk profile/consideration similar to those of Wellington Global Innovation Fund.

However, there is no assurance that the objective of the scheme will be realised.

The Scheme may, at the discretion of the Investment Manager, also invest in the units/ shares of any other similar overseas mutual fund schemes/ETFs.

It shall be noted 'similar overseas mutual fund schemes/ETFs' shall have investment objective, investment strategy, asset allocation and risk profile/consideration similar to those of Wellington Global Innovation Fund.

However, there is no assurance that the objective of the scheme will be realised.

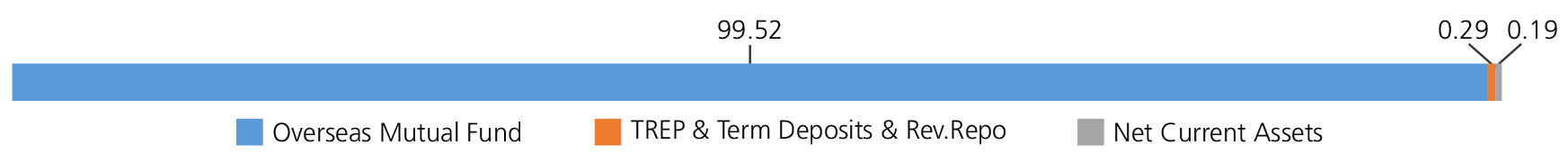

| Instrument/Industry/ Issuer |

Industry/ Rating |

% to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Wellington Global Innovation S USD ACC | Overseas Mutual Fund | 99.52 |

| Mutual Fund Units - Total | 99.52 | |

| Triparty Repo | 0.29 | |

| Net Current Assets/(Liabilities) | 0.19 | |

| Grand Total | 100.00 | |

| Monthly SIP of ₹ 10000 | Since Inception | 1 year |

| Total amount invested (₹) | 3,30,000 | 1,20,000 |

| Total Value as on Mar 31, 2024 (₹) | 3,93,806 | 1,40,569 |

| Scheme Returns (%) | 13.04 | 33.87 |

| MSCI AC World TRI (%) | 16.73 | 32.32 |

| Alpha* | -3.68 | 1.55 |

| MSCI AC World TRI (₹)# | 4,13,083 | 1,39,666 |

| Nifty 50 TRI (₹)^ | 4,14,486 | 1,37,018 |

| Nifty 50 TRI (%) | 16.99 | 27.81 |

| Regular | Direct | |

| Growth | Rs9.4804 | Rs9.8001 |

| IDCW | Rs9.4806 | Rs9.7997 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Arjun Khanna |

| Benchmark | MSCI AC World TRI |

| Allotment date | July 29, 2021 |

| AAUM | Rs961.73 crs |

| AUM | Rs955.80 crs |

| Folio count | 49,393 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load: a) For redemptions or switched out within 1

year from the date of allotment of units,

irrespective of the amount of investment-

1.00%

b) For redemptions or switched out after 1

year from the date of allotment of units,

irrespective of the amount of investment-

NIL

| Regular Plan: | 1.60% |

| Direct Plan: | 0.45% |

Fund

Benchmark

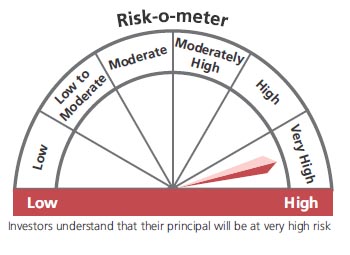

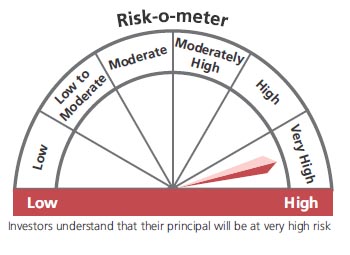

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in units of Wellington Global Innovation Fund or any other similar overseas mutual fund schemes/ETFs.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'