Large & mid cap fund - An open-ended equity scheme investing in both large cap and mid cap stocks

Large & mid cap fund - An open-ended equity scheme investing in both large cap and mid cap stocks

| Instrument/Industry/Issuer | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

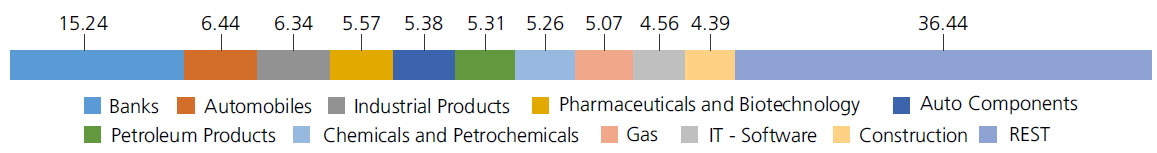

| Banks | 15.24 | |

| State Bank Of India | 4.17 | |

| HDFC Bank Ltd. | 3.50 | |

| Axis Bank Ltd. | 3.27 | |

| ICICI Bank Ltd. | 3.03 | |

| AU Small Finance Bank Ltd. | 0.74 | |

| Bank Of Baroda | 0.53 | |

| Automobiles | 6.44 | |

| Maruti Suzuki India Limited | 4.12 | |

| Hero MotoCorp Ltd. | 2.32 | |

| Industrial Products | 6.34 | |

| Cummins India Ltd. | 2.76 | |

| Bharat Forge Ltd. | 2.67 | |

| AIA Engineering Limited. | 0.91 | |

| Pharmaceuticals and Biotechnology | 5.57 | |

| Sun Pharmaceuticals Industries Ltd. | 2.20 | |

| Ipca Laboratories Ltd. | 1.14 | |

| Cipla Ltd. | 1.13 | |

| GlaxoSmithKline Pharmaceuticals Ltd. | 0.65 | |

| Ajanta Pharma Ltd. | 0.45 | |

| Auto Components | 5.38 | |

| Apollo Tyres Ltd. | 1.93 | |

| Exide Industries Ltd | 1.17 | |

| Schaeffler India Ltd | 1.04 | |

| Balkrishna Industries Ltd. | 0.64 | |

| Bosch Ltd. | 0.60 | |

| Petroleum Products | 5.31 | |

| Reliance Industries Ltd. | 2.39 | |

| Hindustan Petroleum Corporation Ltd | 1.56 | |

| Bharat Petroleum Corporation Ltd. | 1.36 | |

| Chemicals and Petrochemicals | 5.26 | |

| Linde India Ltd. | 2.63 | |

| SRF Ltd. | 1.93 | |

| Tata Chemicals Ltd | 0.70 | |

| Gas | 5.07 | |

| Gail (India) Ltd. | 2.19 | |

| Gujarat State Petronet Ltd. | 1.22 | |

| Petronet LNG Ltd. | 1.06 | |

| Indraprastha Gas Ltd. | 0.60 | |

| IT - Software | 4.56 | |

| Infosys Ltd. | 1.73 | |

| Tata Consultancy Services Ltd. | 1.32 | |

| Mphasis Ltd | 0.90 | |

| Coforge Limited | 0.61 | |

| Construction | 4.39 | |

| Larsen And Toubro Ltd. | 3.53 | |

| Kalpataru Projects International Limited | 0.86 | |

| Cement and Cement Products | 3.81 | |

| JK Cement Ltd. | 1.74 | |

| Ultratech Cement Ltd. | 1.62 | |

| The Ramco Cements Ltd | 0.45 | |

| Electrical Equipment | 3.71 | |

| ABB India Ltd | 1.92 | |

| Thermax Ltd. | 1.79 | |

| Aerospace and Defense | 3.33 | |

| Bharat Electronics Ltd. | 2.89 | |

| Astra Microwave Products Ltd. | 0.44 | |

| Consumer Durables | 3.06 | |

| Blue Star Ltd. | 1.70 | |

| Voltas Ltd. | 0.94 | |

| V-Guard Industries Ltd. | 0.42 | |

| Retailing | 2.85 | |

| Zomato Ltd. | 2.48 | |

| Vedant Fashions Ltd | 0.37 | |

| Finance | 2.49 | |

| CRISIL Ltd. | 1.42 | |

| Shriram Finance Ltd. | 1.07 | |

| Ferrous Metals | 2.22 | |

| Jindal Steel & Power Ltd. | 2.22 | |

| Agricultural, Commercial and Construction Vehicles | 1.90 | |

| Ashok Leyland Ltd. | 1.42 | |

| BEML Ltd. | 0.48 | |

| Telecom - Services | 1.45 | |

| Bharti Airtel Ltd | 1.39 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.06 | |

| Fertilizers and Agrochemicals | 1.33 | |

| Coromandel International Ltd. | 1.33 | |

| Realty | 1.19 | |

| Oberoi Realty Ltd | 1.19 | |

| Beverages | 0.97 | |

| United Spirits Ltd. | 0.97 | |

| Insurance | 0.92 | |

| Max Financial Services Ltd. | 0.92 | |

| Diversified FMCG | 0.91 | |

| Hindustan Unilever Ltd. | 0.91 | |

| Entertainment | 0.73 | |

| Sun TV Network Ltd. | 0.73 | |

| Industrial Manufacturing | 0.64 | |

| Honeywell Automation India Ltd. | 0.64 | |

| Non - Ferrous Metals | 0.62 | |

| Hindalco Industries Ltd | 0.62 | |

| Transport Services | 0.53 | |

| Container Corporation of India Ltd. | 0.53 | |

| Healthcare Services | 0.49 | |

| Fortis Healthcare India Ltd | 0.49 | |

| Equity & Equity related - Total | 96.71 | |

| Mutual Fund Units | ||

| Kotak Liquid Scheme Direct Plan Growth | 0.39 | |

| Mutual Fund Units - Total | 0.39 | |

| Futures | ||

| Tata Chemicals Ltd-APR2024 | 0.42 | |

| Indraprastha Gas Ltd.-APR2024 | 0.11 | |

| Triparty Repo | 2.59 | |

| Net Current Assets/(Liabilities) | 0.31 | |

| Grand Total | 100.00 | |

| | ||

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 52.70, 39.66, 5.13 & 2.51.

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 23,50,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Mar 28, 2024 (₹) | 1,42,16,261 | 29,80,868 | 16,74,628 | 10,63,644 | 5,02,043 | 1,43,133 |

| Scheme Returns (%) | 16.09 | 17.35 | 19.41 | 23.18 | 22.98 | 38.29 |

| Nifty Large Midcap 250 (TRI) Returns (%) | NA | 18.05 | 20.26 | 24.67 | 23.45 | 40.15 |

| Alpha* | NA | -0.69 | -0.85 | -1.48 | -0.47 | -1.86 |

| Nifty Large Midcap 250 (TRI) (₹)# | NA | 30,94,280 | 17,25,936 | 11,02,169 | 5,05,279 | 1,44,203 |

| Nifty 200 (TRI) Returns (%) | 14.02 | 15.72 | 17.56 | 20.71 | 19.74 | 35.98 |

| Alpha* | 2.07 | 1.63 | 1.85 | 2.47 | 3.24 | 2.31 |

| Nifty 200 (TRI) (₹)# | 1,10,85,001 | 27,30,301 | 15,68,091 | 10,02,206 | 4,80,085 | 1,41,798 |

| Nifty 50 (TRI) (₹)^ | 1,04,94,442 | 26,07,368 | 15,05,833 | 9,52,244 | 4,61,270 | 1,37,018 |

| Nifty 50 (TRI) Returns (%) | 13.56 | 14.86 | 16.42 | 18.60 | 16.89 | 27.81 |

| Regular | Direct | |

| Growth | Rs286.4640 | Rs324.2660 |

| IDCW | Rs49.9770 | Rs57.2190 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager*^ | Mr. Harsha Upadhyaya |

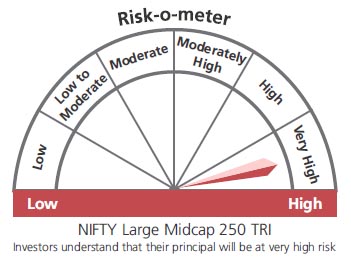

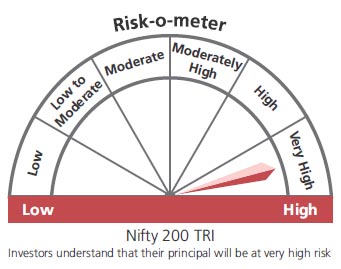

| Benchmark*** | NIFTY Large Midcap 250 TRI (Tier 1), Nifty 200 TRI (Tier 2) |

| Allotment date | September 9, 2004 |

| AAUM | Rs19,413.62 crs |

| AUM | Rs19,861.46 crs |

| Folio count | 5,11,745 |

Trustee's Discretion

| Portfolio Turnover | 32.12% |

| $Beta | 0.84 |

| $Sharpe ## | 1.00 |

| $Standard Deviation | 11.66% |

| (P/E) | 32.44 |

| P/BV | 4.00 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.62% |

| Direct Plan: | 0.53% |

Benchmark- Tier 1

Benchmark- Tier 2

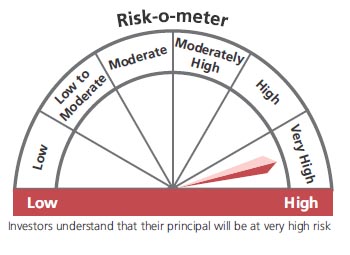

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in portfolio of predominantly equity & equity related securities of large & midcap companies.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2024. An addendum may be issued or updated on the website for new riskometer.

***As per para 1.9 of of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2023/74 dated May 19, 2023 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

^Mr. Arjun Khanna (Dedicated fund manager for investments in foreign securities).

## Risk rate assumed to be 7.90% (FBIL Overnight MIBOR rate as on 28th March 2024).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'