| Instrument/Industry/ Issuer |

Industry/ Rating |

% to Net Assets |

|

|---|---|---|---|

| Equity & Equity related |

|||

| Banks | 3.88 | ||

| HDFC Bank Ltd. | 1.12 | ||

| Bank Of Baroda | 1.02 | ||

| IndusInd Bank Ltd. | 0.67 | ||

| Axis Bank Ltd. | 0.66 | ||

| INDIAN BANK | 0.41 | ||

| Automobiles | 3.25 | ||

| Maruti Suzuki India Limited | 1.83 | ||

| Hero MotoCorp Ltd. | 1.42 | ||

| Finance | 1.85 | ||

| Power Finance Corporation Ltd. | 1.53 | ||

| Mahindra & Mahindra Financial Services Ltd. | 0.17 | ||

| Jio Financial Services Ltd | 0.15 | ||

| Petroleum Products | 1.82 | ||

| Hindustan Petroleum Corporation Ltd | 0.92 | ||

| Reliance Industries Ltd. | 0.90 | ||

| Diversified FMCG | 1.23 | ||

| Hindustan Unilever Ltd. | 0.83 | ||

| ITC Ltd. | 0.40 | ||

| Power | 1.17 | ||

| National Thermal Power Corporation Limited | 1.17 | ||

| IT - Software | 1.16 | ||

| Infosys Ltd. | 0.33 | ||

| Tech Mahindra Ltd. | 0.32 | ||

| Mphasis Ltd | 0.26 | ||

| Wipro Ltd. | 0.25 | ||

| Gas | 0.93 | ||

| Gail (India) Ltd. | 0.93 | ||

| Beverages | 0.91 | ||

| Radico Khaitan Ltd. | 0.44 | ||

| United Spirits Ltd. | 0.28 | ||

| United Breweries Ltd. | 0.19 | ||

| Telecom - Services | 0.90 | ||

| Bharti Airtel Ltd | 0.86 | ||

| Bharti Airtel Ltd - Partly Paid Shares | 0.04 | ||

| Auto Components | 0.85 | ||

| Subros Ltd. | 0.45 | ||

| Samvardhana Motherson International Limited | 0.40 | ||

| Food Products | 0.80 | ||

| Prataap Snacks Ltd | 0.48 | ||

| Britannia Industries Ltd. | 0.32 | ||

| Consumer Durables | 0.77 | ||

| Pokarna Ltd. | 0.28 | ||

| Kansai Nerolac Paints Ltd | 0.25 | ||

| Century Plyboards (India) Ltd. | 0.24 | ||

| Insurance | 0.69 | ||

| Life Insurance Corporation Of India Ltd. | 0.69 | ||

| Realty | 0.66 | ||

| Signature Global Ltd | 0.36 | ||

| Mahindra Lifespace Developers Ltd | 0.30 | ||

| Cement and Cement Products | 0.51 | ||

| Ambuja Cements Ltd. | 0.26 | ||

| Ultratech Cement Ltd. | 0.25 | ||

| Electrical Equipment | 0.50 | ||

| Voltamp Transformers Ltd. | 0.50 | ||

| Construction | 0.30 | ||

| PNC Infratech Ltd | 0.20 | ||

| KNR Constructions Ltd. | 0.10 | ||

| Healthcare Services | 0.35 | ||

| Fortis Healthcare India Ltd | 0.35 | ||

| Industrial Manufacturing | 0.35 | ||

| Jyoti CNC Automation Ltd | 0.35 | ||

| Personal Products | 0.26 | ||

| Godrej Consumer Products Ltd. | 0.26 | ||

| Entertainment | 0.24 | ||

| Zee Entertainment Enterprises Ltd | 0.24 | ||

| Leisure Services | 0.22 | ||

| Jubilant Foodworks Limited | 0.14 | ||

| Barbeque Nation Hospitality Ltd. | 0.08 | ||

| Retailing | 0.14 | ||

| Sai Silk (Kalamandir) Ltd | 0.14 | ||

| Pharmaceuticals and Biotechnology | 0.10 | ||

| Zydus Lifesciences Limited | 0.08 | ||

| Innova Captabs Ltd | 0.02 | ||

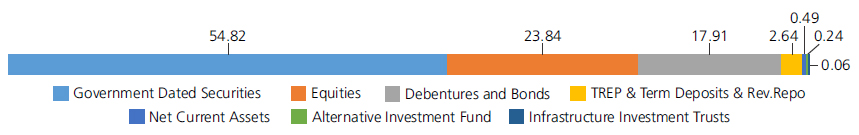

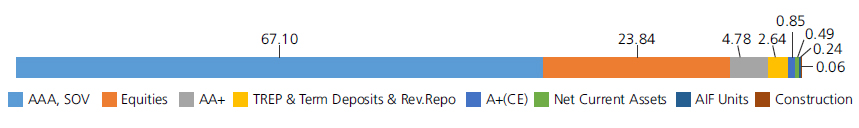

| Equity & Equity related - Total | 23.84 | ||

| Infrastructure Investment Trusts | |||

| BHARAT HIGHWAYS INVIT | Construction | 0.06 | |

| Infrastructure Investment Trusts - Total | 0.06 | ||

| Debt Instruments | |||

| Debentures and Bonds | |||

| Government Dated Securities | |||

| 7.18% Central Government | SOV | 30.59 | |

| 8.34% Central Government(^) | SOV | 10.09 | |

| 7.25% Central Government | SOV | 5.22 | |

| 7.17% Central Government | SOV | 2.50 | |

| 7.45% Maharashtra State Govt-Maharashtra | SOV | 1.72 | |

| 8.12% Central Government(^) | SOV | 1.51 | |

| 7.30% Central Government | SOV | 1.07 | |

| 7.95% Central Government | SOV | 0.43 | |

| 7.65% Madhya Pradesh State Govt-Madhya Pradesh | SOV | 0.22 | |

| 6.57% Andhra Pradesh State Govt-Andhra Pradesh | SOV | 0.21 | |

| GS 5.63% CG 12/04/2026 - (STRIPS) | SOV | 0.19 | |

| 7.69% Central Government(^) | SOV | 0.18 | |

| 7.96% Punjab State Govt-Punjab | SOV | 0.13 | |

| 7.84% Maharashtra State Govt-Maharashtra | SOV | 0.13 | |

| 7.96% Maharashtra State Govt-Maharashtra | SOV | 0.11 | |

| 9.15% Central Government | SOV | 0.09 | |

| 8.05% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.09 | |

| 8.29% Andhra Pradesh State Govt-Andhra Pradesh | SOV | 0.08 | |

| 7.98% Kerala State Govt-Kerala | SOV | 0.07 | |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.06 | |

| 7.26% Central Government(^) | SOV | 0.05 | |

| GS CG 23/12/2025 - (STRIPS) | SOV | 0.04 | |

| GS CG 22 Feb 2027 - (STRIPS) | SOV | 0.04 | |

| Government Dated Securities - Total | 54.82 | ||

| Public Sector Undertakings | |||

| State Bank of India. (Basel III TIER I Bonds) | CRISIL AA+ | 3.49 | |

| Power Finance Corporation Ltd. (^) | CRISIL AAA | 1.42 | |

| National Bank For Agriculture & Rural Development | CRISIL AAA | 1.38 | |

| Punjab National Bank (Basel III TIER I Bonds) | CRISIL AA+ | 1.29 | |

| Small Industries Development Bank Of India | CRISIL AAA | 1.08 | |

| Rural Electrification Corporation Ltd. | CRISIL AAA | 1.07 | |

| National Thermal Power Corporation Ltd. | CRISIL AAA | 1.03 | |

| Small Industries Development Bank Of India | ICRA AAA | 0.86 | |

| U P Power Corporation Ltd ( Guaranteed By UP State Government ) | CRISIL A+(CE) | 0.85 | |

| Rural Electrification Corporation Ltd. | CRISIL AAA | 0.26 | |

| Power Finance Corporation Ltd. | CRISIL AAA | 0.20 | |

| Indian Railway Finance Corporation Ltd. | CRISIL AAA | 0.18 | |

| Power Grid Corporation of India Ltd. | CRISIL AAA | 0.08 | |

| Public Sector Undertakings - Total | 13.19 | ||

| Corporate Debt/Financial Institutions | |||

| HDFC Bank Ltd. | CRISIL AAA | 4.29 | |

| Aditya Birla Finance Ltd. | ICRA AAA | 0.43 | |

| Corporate Debt/Financial Institutions - Total | 4.72 | ||

| Triparty Repo | 2.64 | ||

| Alternative Investment Fund | |||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | AIF Units | 0.24 | |

| Alternative Investment Fund - Total | 0.24 | ||

| Net Current Assets/(Liabilities) | 0.49 | ||

| Grand Total | 100.00 | ||

| | |||

| Monthly SIP of (Rs) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 24,40,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Mar 31, 2024 (₹) | 67,48,711 | 20,27,029 | 12,31,035 | 8,03,231 | 4,26,753 | 1,30,376 |

| Scheme Returns (%) | 9.11 | 10.13 | 10.76 | 11.66 | 11.44 | 16.71 |

| CRISIL Hybrid 85+15 - Conservative Index Returns (%) | 8.74 | 8.78 | 8.66 | 8.58 | 8.58 | 12.36 |

| Alpha* | 0.37 | 1.35 | 2.10 | 3.08 | 2.86 | 4.35 |

| CRISIL Hybrid 85+15 - Conservative Index (₹)# | 64,56,301 | 18,87,428 | 11,42,277 | 7,44,109 | 4,09,348 | 1,27,724 |

| CRISIL 10 Year Gilt Index (₹)^ | 48,21,645 | 16,33,181 | 10,24,875 | 6,83,054 | 3,94,261 | 1,25,315 |

| CRISIL 10 Year Gilt Index Returns (%) | 6.25 | 6.02 | 5.61 | 5.15 | 6.03 | 8.46 |

| Regular | Direct | |

| Growth | Rs52.3978 | Rs59.5619 |

| Monthly IDCW | Rs12.7897 | Rs13.8424 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager*^ | Mr. Devender Singhal & Mr. Abhishek Bisen |

| Benchmark | CRISIL Hybrid 85+15 - Conservative Index |

| Allotment date | December 02, 2003 |

| AAUM | Rs2,318.99 crs |

| AUM | Rs2,330.73 crs |

| Folio count | 39,141 |

Monthly (12th of every Month)

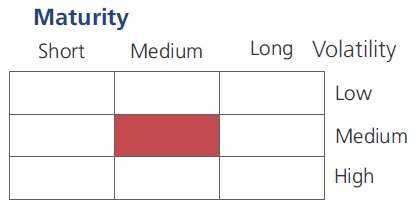

| Average Maturity | 18.00 yrs |

| Modified Duration | 6.59 yrs |

| Macaulay Duration | 6.89 yrs |

| Annualised YTM* | 7.55% |

| $Standard Deviation | 0.50% |

| P/E$$ | 25.43 |

| P/BV$$ | 0.09 |

*in case of semi annual YTM, it will be annualized.

$$Equity Component of the Portfolio.

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 3 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 8%

of the initial investment amount (limit)

purchased or switched in within 6 months

from the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 6 months from the

date of allotment: 1%

c) If units are redeemed or switched out

after 6 months from the date of allotment:

NIL

| Regular Plan: | 1.72% |

| Direct Plan: | 0.50% |

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Income & capital growth over a long term horizon

- Investment in a portfolio of debt instruments with a moderate exposure in equity & equity related instruments

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2024. An addendum may be issued or updated on the website for new riskometer.

(^) Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 31 Mar 2024 is 3.21% of the net assets.

##Risk rate assumed to be 7.90% (FBIL Overnight MIBOR rate as on 28th March 2024).**Total Expense Ratio includes applicable B30 fee and GST.

^Ms. Palha Khanna (Dedicated fund manager for investments in foreign securities)

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'