| KOTAK BANKING AND PSU DEBT FUND

An open ended debt scheme predominantly investing in Debtinstruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds.

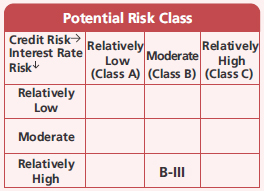

A relatively high interest rate risk and moderate credit risk.

An open ended debt scheme predominantly investing in Debtinstruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds.

A relatively high interest rate risk and moderate credit risk.

| KOTAK BANKING AND PSU DEBT FUND

An open ended debt scheme predominantly investing in Debtinstruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds.

A relatively high interest rate risk and moderate credit risk.

An open ended debt scheme predominantly investing in Debtinstruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds.

A relatively high interest rate risk and moderate credit risk.

Investment Objective

To generate income by predominantly investing in debt & money market securities issued by Banks, Public Sector

Undertaking (PSUs), Public Financial Institutions (PFI), Municipal Bonds and Reverse repos in such securities, sovereign securities issued by the

Central Government & State Governments, and / or any security unconditionally.guaranteed by the Govt. of India. There is no assurance that

or guarantee that the investment objective of the scheme will be achieved.

To generate income by predominantly investing in debt & money market securities issued by Banks, Public Sector

Undertaking (PSUs), Public Financial Institutions (PFI), Municipal Bonds and Reverse repos in such securities, sovereign securities issued by the

Central Government & State Governments, and / or any security unconditionally.guaranteed by the Govt. of India. There is no assurance that

or guarantee that the investment objective of the scheme will be achieved.

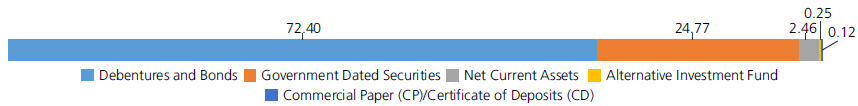

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 7.18% Central Government(^) | SOV | 19.03 |

| 8.34% Central Government(^) | SOV | 5.08 |

| 7.63% Maharashtra State Govt-Maharashtra | SOV | 0.65 |

| 6.46% Gujarat State Govt-Gujarat | SOV | 0.01 |

| Government Dated Securities - Total | 24.77 | |

| Public Sector Undertakings | ||

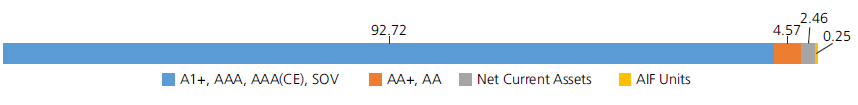

| Power Finance Corporation Ltd. (^) | CRISIL AAA | 8.02 |

| Rural Electrification Corporation Ltd. | CRISIL AAA | 7.80 |

| Small Industries Development Bank Of India | CRISIL AAA | 7.19 |

| National Bank For Agriculture & Rural Development | ICRA AAA | 5.86 |

| DME Development Limited (^) | CRISIL AAA | 5.36 |

| Power Grid Corporation of India Ltd.(^) | CRISIL AAA | 4.89 |

| State Bank of India. (Basel III TIER II Bonds) | CRISIL AAA | 2.34 |

| Union Bank of India (Basel III TIER I Bonds) | CARE AA | 2.31 |

| Indian Bank (Basel III TIER II Bonds) | FITCH AA+ | 1.93 |

| Punjab National Bank (Basel III TIER II Bonds)(^) | CRISIL AAA | 1.81 |

| Indian Railway Finance Corporation Ltd. | CRISIL AAA | 1.68 |

| Rural Electrification Corporation Ltd. | ICRA AAA | 1.67 |

| Canara Bank (Basel III TIER II Bonds) | FITCH AAA | 1.65 |

| Nuclear Power Corporation Of India Ltd. | ICRA AAA | 1.26 |

| Rural Electrification Corporation Ltd. | CRISIL AAA | 1.12 |

| National Bank For Agriculture & Rural Development | CRISIL AAA | 0.91 |

| Food Corporation of India | CRISIL AAA(CE) | 0.87 |

| Food Corporation of India (^) | CRISIL AAA(CE) | 0.83 |

| Mahanagar Telephone Nigam Ltd. | CRISIL AAA(CE) | 0.81 |

| Bank of Baroda (Basel III TIER I Bonds) | CRISIL AA+ | 0.33 |

| Bank of Baroda (Basel III TIER II Bonds) | FITCH AAA | 0.22 |

| Power Finance Corporation Ltd. | CRISIL AAA | 0.21 |

| Mahanagar Telephone Nigam Ltd. | CARE AAA(CE) | 0.08 |

| Public Sector Undertakings - Total | 59.15 | |

| Corporate Debt/Financial Institutions | ||

| HDFC Bank Ltd. (^) | CRISIL AAA | 10.75 |

| LIC Housing Finance Ltd. | CRISIL AAA | 2.50 |

| Corporate Debt/Financial Institutions - Total | 13.25 | |

| Money Market Instruments | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | ||

| Public Sector Undertakings | ||

| Canara Bank | CRISIL A1+ | 0.12 |

| Public Sector Undertakings - Total | 0.12 | |

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | AIF Units | 0.25 |

| Alternative Investment Fund - Total | 0.25 | |

| Net Current Assets/(Liabilities) | 2.46 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 30,40,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Mar 31, 2024 (₹) | 82,31,925 | 17,22,864 | 10,62,982 | 6,99,669 | 3,94,915 | 1,24,715 |

| Scheme Returns (%) | 7.11 | 7.04 | 6.64 | 6.11 | 6.14 | 7.49 |

| CRISIL Banking and PSU Debt Index Returns (%) | NA | 7.03 | 6.53 | 6.01 | 6.09 | 7.76 |

| Alpha* | NA | 0.01 | 0.11 | 0.10 | 0.05 | -0.27 |

| CRISIL Banking and PSU Debt Index (₹)# | NA | 17,21,844 | 10,58,701 | 6,97,928 | 3,94,596 | 1,24,880 |

| CRISIL 10 Year Gilt Index (₹)^ | NA | 16,33,181 | 10,24,875 | 6,83,054 | 3,94,261 | 1,25,315 |

| CRISIL 10 Year Gilt Index (%) | NA | 6.02 | 5.61 | 5.15 | 6.03 | 8.46 |

Scheme Inception : - December 29, 1998. The returns are calculated by XIRR approach assuming investment of ₹10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and

final value and a series of cash inflows and outflows and taking the time of investment into consideration. Since inception returns are assumed to be starting from the beginning of the subsequent month from the date of

inception. The SIP Performance is for Regular Plan – Growth Option Different plans have different expense structure. # Benchmark; ^ Additional Benchmark. Alpha is difference of scheme return with benchmark return. *All

payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer.

Net Asset Value (NAV)

| Regular | Direct | |

| Growth | Rs59.1289 | Rs61.3253 |

| IDCW | Rs11.1089 | Rs10.2799 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager*^ | Mr. Deepak Agrawal, Mr. Abhishek Bisen |

| Benchmark | CRISIL Banking and PSU Debt Index - effective upto March 31, 2024 CRISIL Banking & PSU Debt A-II Index - effective from April 1, 2024 |

| Allotment date | December 29,1998 |

| AAUM | Rs5,967.43 crs |

| AUM | Rs5,991.60 crs |

| Folio count | 17,083 |

IDCW Frequency

Monthly (12th of every Month)

Debt Quant & Ratios

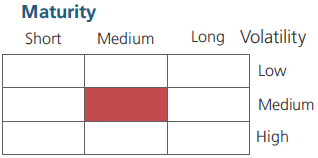

| Average Maturity | 8.81 yrs |

| Modified Duration | 4.11 yrs |

| Macaulay Duration | 4.36 yrs |

| Annualised YTM* | 7.74% |

| $Standard Deviation | 0.68% |

Source: $ICRA MFI Explorer.

Minimum Investment Amount

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

Ideal Investments Horizon

• 2-3 years

Load Structure

Entry Load:

Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

| Regular Plan: | 0.81% |

| Direct Plan: | 0.37% |

Data as on 31st March, 2024 unless

otherwise specified.

^Ms. Palha Khanna (Dedicated fund manager for investments in foreign securities).

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Income over a short to medium term investment horizon.

- Investment in debt & money market securities of PSUs , Banks , Public Finanacial Institutions, government securities, and Municipal Bonds.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2024. An addendum may be issued or updated on the website for new riskometer.

(^)Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 31 Mar 2024 is 1.66% of the net assets.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'