Investment Objective

The investment objective of the scheme is

to generate long-term capital appreciation

from a diversified portfolio of equity and

equity related securities and enable

investors to avail the income tax rebate, as

permitted from time to time however, there

is no assurance that the objective of the

scheme will be realized.

The investment objective of the scheme is

to generate long-term capital appreciation

from a diversified portfolio of equity and

equity related securities and enable

investors to avail the income tax rebate, as

permitted from time to time however, there

is no assurance that the objective of the

scheme will be realized.

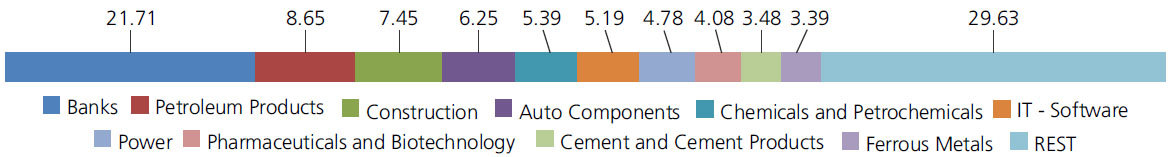

| Instrument/Industry/Issuer | |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

| Banks | 21.71 | |

| HDFC Bank Ltd. | 7.18 | |

| ICICI Bank Ltd. | 4.13 | |

| State Bank Of India | 3.76 | |

| Axis Bank Ltd. | 3.73 | |

| Bank Of Baroda | 1.58 | |

| Kotak Mahindra Bank Ltd. | 1.33 | |

| Petroleum Products | 8.65 | |

| Reliance Industries Ltd. | 4.62 | |

| Hindustan Petroleum Corporation Ltd | 2.04 | |

| Bharat Petroleum Corporation Ltd. | 1.99 | |

| Construction | 7.45 | |

| Larsen And Toubro Ltd. | 3.42 | |

| Kalpataru Projects International Limited | 1.69 | |

| KNR Constructions Ltd. | 1.43 | |

| Ashoka Buildcon Limited | 0.55 | |

| G R Infraprojects Limited | 0.36 | |

| Auto Components | 6.25 | |

| Bosch Ltd. | 2.91 | |

| Exide Industries Ltd | 1.39 | |

| Bharat Forge Ltd. | 1.37 | |

| JK Tyre & Industries Ltd. | 0.58 | |

| Chemicals and Petrochemicals | 5.39 | |

| Linde India Ltd. | 2.72 | |

| SRF Ltd. | 1.44 | |

| Solar Industries India Limited | 1.23 | |

| IT - Software | 5.19 | |

| Infosys Ltd. | 3.08 | |

| Tech Mahindra Ltd. | 2.11 | |

| Power | 4.78 | |

| National Thermal Power Corporation Limited | 3.10 | |

| Power Grid Corporation Of India Ltd. | 1.68 | |

| Pharmaceuticals and Biotechnology | 4.08 | |

| Sun Pharmaceuticals Industries Ltd. | 1.87 | |

| Zydus Lifesciences Limited | 1.12 | |

| Cipla Ltd. | 1.09 | |

| Cement and Cement Products | 3.48 | |

| Ambuja Cements Ltd. | 1.76 | |

| Ultratech Cement Ltd. | 1.72 | |

| Ferrous Metals | 3.39 | |

| Jindal Steel & Power Ltd. | 2.31 | |

| Tata Steel Ltd. | 1.08 | |

| Automobiles | 3.28 | |

| Hero MotoCorp Ltd. | 2.29 | |

| Maruti Suzuki India Limited | 0.99 | |

| Industrial Products | 3.01 | |

| Carborundum Universal Ltd. | 1.14 | |

| Cummins India Ltd. | 1.07 | |

| SKF India Ltd | 0.80 | |

| Consumer Durables | 2.87 | |

| Blue Star Ltd. | 1.41 | |

| Voltas Ltd. | 1.21 | |

| Hawkins Cooker Ltd | 0.25 | |

| Gas | 2.82 | |

| GAIL (India) Ltd. | 2.16 | |

| Gujarat State Petronet Ltd. | 0.66 | |

| Electrical Equipment | 2.26 | |

| ABB India Ltd | 1.25 | |

| Thermax Ltd. | 1.01 | |

| Telecom - Services | 2.14 | |

| Bharti Airtel Ltd | 1.69 | |

| Bharti Hexacom Ltd. | 0.39 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.06 | |

| Diversified FMCG | 2.13 | |

| Hindustan Unilever Ltd. | 2.13 | |

| Aerospace and Defense | 1.73 | |

| Data Patterns (India) Ltd. | 1.73 | |

| Finance | 1.53 | |

| CRISIL Ltd. | 0.80 | |

| Sundaram Finance Ltd. | 0.73 | |

| Capital Markets | 1.33 | |

| ICICI Securities Ltd | 0.91 | |

| Dee Development Engineeers Ltd | 0.42 | |

| Fertilizers and Agrochemicals | 1.31 | |

| Coromandel International Ltd. | 1.31 | |

| Industrial Manufacturing | 1.26 | |

| Kaynes Technology India Ltd. | 1.26 | |

| Beverages | 1.15 | |

| United Spirits Ltd. | 1.15 | |

| Entertainment | 0.99 | |

| Sun TV Network Ltd. | 0.99 | |

| Non - Ferrous Metals | 0.68 | |

| Hindalco Industries Ltd | 0.68 | |

| Textiles and Apparels | 0.44 | |

| Garware Technical Fibres Ltd. | 0.44 | |

| Equity & Equity related - Total | 99.30 | |

| Triparty Repo | 0.65 | |

| Net Current Assets/(Liabilities) | 0.05 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 22,40,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on June 28, 2024 (₹) | 1,10,65,967 | 31,62,736 | 18,08,725 | 11,39,088 | 5,35,673 | 1,48,827 |

| Scheme Returns (%) | 15.16 | 18.45 | 21.57 | 26.02 | 27.73 | 48.14 |

| Nifty 500 (TRI) Returns (%) | 14.72 | 17.60 | 20.37 | 24.76 | 25.50 | 43.24 |

| Alpha* | 0.44 | 0.84 | 1.20 | 1.27 | 2.23 | 4.90 |

| Nifty 500 (TRI) (₹)# | 1,05,28,697 | 30,22,624 | 17,33,577 | 11,05,150 | 519,822 | 1,46,039 |

| Nifty 50 (TRI) (₹)^ | 92,83,778 | 27,33,445 | 15,75,620 | 9,95,998 | 480,654 | 1,39,256 |

| Nifty 50 (TRI) Returns (%) | 13.61 | 15.73 | 17.68 | 20.44 | 19.80 | 31.54 |

Scheme Inception : - November 23, 2005. The returns are calculated by XIRR approach assuming investment of ₹10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a

series of cash inflows and outflows and taking the time of investment into consideration. Since inception returns are assumed to be starting from the beginning of the subsequent month from the date of inception. The SIP Performance is for Regular

Plan – Growth Option Different plans have different expense structure. # Benchmark; ^ Additional Benchmark. TRI – Total Return Index, In terms of para 6.14 of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024,

the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI). Alpha is difference of scheme return with benchmark return. *All payouts during the period have been

reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer.

Net Asset Value (NAV)

| Regular | Direct | |

| Growth | Rs115.9940 | Rs134.2320 |

| IDCW | Rs43.4100 | Rs56.2290 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Growth and IDCW (Payout)

(applicable for all plans)

| Fund Manager* | Mr. Harsha Upadhyaya |

| Benchmark | Nifty 500 TRI |

| Allotment date | November 23, 2005 |

| AAUM | Rs5,988.65 crs |

| AUM | Rs6,100.96 crs |

| Folio count | 5,03,765 |

IDCW Frequency

Trustee's Discretion

Ratios

| Portfolio Turnover | 29.09% |

| $Beta | 0.82 |

| $Sharpe ## | 1.15 |

| $Standard Deviation | 11.50% |

| (P/E) | 22.18 |

| P/BV | 3.71 |

Minimum Investment Amount

Initial & Additional Investment

• Rs500 and in multiples of Rs500

Systematic Investment Plan (SIP)

• Rs500 and in multiples of Rs500

Ideal Investments Horizon

• 5 years & above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil. (applicable for all plans)

Total Expense Ratio**

| Regular Plan: | 1.75% |

| Direct Plan: | 0.58% |

Data as on 30th June, 2024 unless

otherwise specified.

Fund

Benchmark

This product is suitable for investors who are seeking*:

Benchmark

This product is suitable for investors who are seeking*:

- long term capital growth with a 3 year lock in

- Investment in portfolio of predominantly equity & equity related securities.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

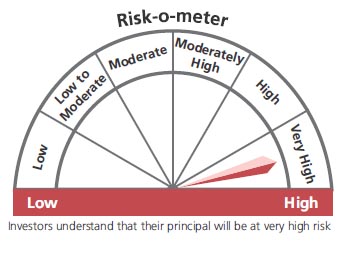

The above risk-o—meter is based on the scheme portfolio as on 30th June, 2024. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 6.86% (FBIL Overnight MIBOR rate as on 28th Jun 2024).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'