An Open Ended Scheme investing in Equity, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

An Open Ended Scheme investing in Equity, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

| Instrument/Industry/ Issuer |

Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

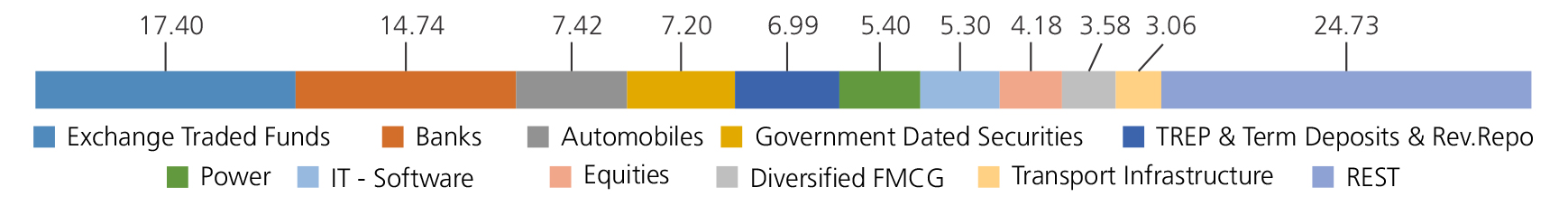

| Banks | 14.74 | |

| HDFC Bank Ltd. | 7.96 | |

| State Bank Of India | 2.21 | |

| Bank Of Baroda | 1.94 | |

| IndusInd Bank Ltd. | 0.90 | |

| Jammu And Kashmir Bank Ltd. | 0.73 | |

| City Union Bank Ltd. | 0.51 | |

| RBL Bank Ltd | 0.19 | |

| Axis Bank Ltd. | 0.15 | |

| Federal Bank Ltd. | 0.11 | |

| Bandhan Bank Ltd. | 0.04 | |

| Automobiles | 7.42 | |

| Maruti Suzuki India Limited | 4.43 | |

| Hero MotoCorp Ltd. | 2.99 | |

| Power | 5.40 | |

| National Thermal Power Corporation Limited | 3.93 | |

| NLC India Ltd. | 1.47 | |

| IT - Software | 5.30 | |

| Tech Mahindra Ltd. | 1.53 | |

| Oracle Financial Services Software Ltd | 1.21 | |

| Infosys Ltd. | 1.08 | |

| Mphasis Ltd | 0.80 | |

| Persistent Systems Limited | 0.58 | |

| Tata Consultancy Services Ltd. | 0.10 | |

| Finance | 4.18 | |

| Power Finance Corporation Ltd. | 2.68 | |

| Mahindra & Mahindra Financial Services Ltd. | 0.83 | |

| Bajaj Finserv Ltd. | 0.38 | |

| Manappuram Finance Ltd | 0.15 | |

| Bajaj Finance Ltd. | 0.07 | |

| Rural Electrification Corporation Ltd | 0.07 | |

| Diversified FMCG | 3.58 | |

| Hindustan Unilever Ltd. | 1.82 | |

| ITC Ltd. | 1.76 | |

| Transport Infrastructure | 3.06 | |

| Adani Port and Special Economic Zone Ltd. | 3.06 | |

| Auto Components | 2.25 | |

| Samvardhana Motherson International Limited | 1.75 | |

| Subros Ltd. | 0.50 | |

| Entertainment | 2.23 | |

| Zee Entertainment Enterprises Ltd | 0.84 | |

| Sun TV Network Ltd. | 0.73 | |

| PVR Inox Limited | 0.66 | |

| Cement and Cement Products | 1.90 | |

| Ambuja Cements Ltd. | 1.90 | |

| Gas | 1.68 | |

| GAIL (India) Ltd. | 1.68 | |

| Industrial Manufacturing | 1.66 | |

| Jyoti CNC Automation Ltd | 1.66 | |

| Telecom - Services | 1.52 | |

| Bharti Airtel Ltd | 1.52 | |

| Retailing | 1.38 | |

| Zomato Ltd. | 1.38 | |

| Capital Markets | 1.33 | |

| ICICI Securities Ltd | 0.81 | |

| Dee Development Engineeers Ltd | 0.52 | |

| Insurance | 1.20 | |

| Life Insurance Corporation Of India Ltd. | 1.19 | |

| SBI Life Insurance Company Ltd | 0.01 | |

| Healthcare Services | 1.15 | |

| Fortis Healthcare India Ltd | 0.92 | |

| GPT Healthcare Limited | 0.23 | |

| Beverages | 1.12 | |

| Radico Khaitan Ltd. | 1.12 | |

| Personal Products | 1.06 | |

| Emami Ltd. | 1.06 | |

| Minerals and Mining | 1.02 | |

| NMDC Ltd. | 1.02 | |

| Consumable Fuels | 0.76 | |

| Coal India Ltd. | 0.76 | |

| Ferrous Metals | 0.72 | |

| Tata Steel Ltd. | 0.54 | |

| Steel Authority of India Ltd. | 0.18 | |

| Petroleum Products | 0.43 | |

| Reliance Industries Ltd. | 0.31 | |

| Hindustan Petroleum Corporation Ltd | 0.12 | |

| Printing and Publication | 0.39 | |

| Navneet Education Ltd. | 0.39 | |

| Construction | 0.27 | |

| Ashoka Buildcon Limited | 0.27 | |

| Realty | 0.31 | |

| DLF Ltd. | 0.31 | |

| Leisure Services | 0.29 | |

| Barbeque Nation Hospitality Ltd. | 0.29 | |

| Non - Ferrous Metals | 0.12 | |

| Hindustan Copper Ltd. | 0.12 | |

| Metals and Minerals Trading | 0.10 | |

| Adani Enterprises Ltd. | 0.10 | |

| Transport Services | 0.05 | |

| Inter Globe Aviation Ltd | 0.05 | |

| Pharmaceuticals and Biotechnology | 0.01 | |

| Aurobindo Pharma Ltd. | 0.01 | |

| Equity & Equity related - Total | 66.63 | |

| Mutual Fund Units | ||

| Kotak Mutual Fund - Kotak Gold ETF | Exchange Traded Funds | 10.07 |

| Kotak Mutual Fund - Kotak Silver ETF | Exchange Traded Funds | 7.33 |

| Mutual Fund Units - Total | 17.40 | |

| Futures | ||

| Aurobindo Pharma Ltd.-JUL2024 | -0.01 | |

| SBI Life Insurance Company Ltd-JUL2024 | -0.01 | |

| Bharti Airtel Ltd-JUL2024 | -0.03 | |

| Bandhan Bank Ltd.-JUL2024 | -0.04 | |

| Bank Of Baroda-JUL2024 | -0.04 | |

| Inter Globe Aviation Ltd-JUL2024 | -0.05 | |

| Bajaj Finance Ltd.-JUL2024 | -0.07 | |

| Rural Electrification Corporation Ltd-JUL2024 | -0.07 | |

| Adani Enterprises Ltd.-JUL2024 | -0.10 | |

| Federal Bank Ltd.-JUL2024 | -0.11 | |

| Tata Consultancy Services Ltd.-JUL2024 | -0.11 | |

| Hindustan Copper Ltd.-JUL2024 | -0.12 | |

| Hindustan Petroleum Corporation Ltd-JUL2024 | -0.12 | |

| Manappuram Finance Ltd-JUL2024 | -0.15 | |

| IndusInd Bank Ltd.-JUL2024 | -0.16 | |

| Steel Authority of India Ltd.-JUL2024 | -0.18 | |

| RBL Bank Ltd-JUL2024 | -0.19 | |

| DLF Ltd.-JUL2024 | -0.31 | |

| Reliance Industries Ltd.-JUL2024 | -0.31 | |

| Bajaj Finserv Ltd.-JUL2024 | -0.38 | |

| Ambuja Cements Ltd.-JUL2024 | -0.41 | |

| Coal India Ltd.-JUL2024 | -0.77 | |

| NMDC Ltd.-JUL2024 | -1.03 | |

| HDFC Bank Ltd.-JUL2024 | -1.12 | |

| National Thermal Power Corporation Limited-JUL2024 | -1.92 | |

| Adani Port and Special Economic Zone Ltd.-JUL2024 | -3.08 | |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Corporate Debt/Financial Institutions | ||

| India Grid Trust | CRISIL AAA | 0.77 |

| Bajaj Finance Ltd. | CRISIL AAA | 0.38 |

| HDFC Bank Ltd. | CRISIL AAA | 0.08 |

| Corporate Debt/Financial Institutions - Total | 1.23 | |

| Public Sector Undertakings | ||

| Small Industries Development Bank Of India | CRISIL AAA | 0.15 |

| Public Sector Undertakings - Total | 0.15 | |

| Government Dated Securities | ||

| 7.18% Central Government | SOV | 3.25 |

| 7.06% Central Government | SOV | 1.92 |

| 8.34% Central Government(^) | SOV | 1.17 |

| 7.17% Central Government | SOV | 0.46 |

| 8.00% Central Government(^) | SOV | 0.38 |

| 8.40% Central Government | SOV | 0.02 |

| Government Dated Securities - Total | 7.20 | |

| Real Estate & Infrastructure Investment Trusts | ||

| BHARAT HIGHWAYS INVIT | Construction | 0.06 |

| Real Estate & Infrastructure Investment Trusts - Total | 0.06 | |

| Triparty Repo | 6.99 | |

| Net Current Assets/(Liabilities) | 0.34 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs 12.5640 | Rs12.7100 |

| IDCW | Rs 12.5640 | Rs12.7090 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager*^ |

Mr. Devender Singhal, Mr. Abhishek Bisen, Mr. Hiten Shah & Mr. Jeetu Valechha Sonar |

| Benchmark | NIFTY 500 TRI (65%) + NIFTY Short Duration Debt Index (25%) + Domestic Price of Gold (5%) + Domestic Price of Silver (5%) |

| Allotment date | September 22, 2023 |

| AAUM | Rs6,361.04 crs |

| AUM | Rs6,525.61 crs |

| Folio count | 1,39,670 |

Trustee's Discretion

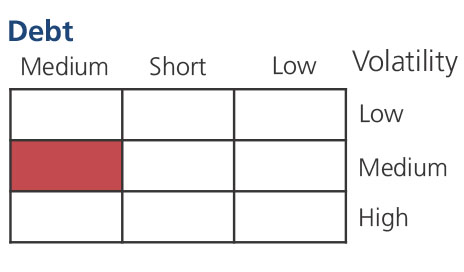

| Average Maturity | 3.90 yrs |

| Modified Duration | 2.21 yrs |

| Macaulay Duration | 2.28 yrs |

| Annualised YTM* | 7.13% |

| Portfolio Turnover | 184.15% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 30%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

| Regular Plan: | 1.75% |

| Direct Plan: | 0.31% |

Fund

Benchmark

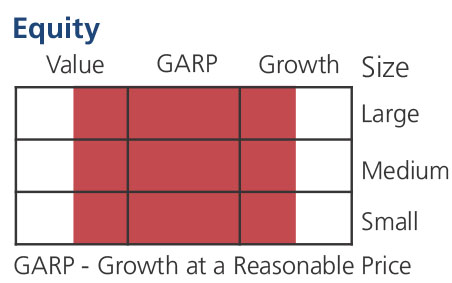

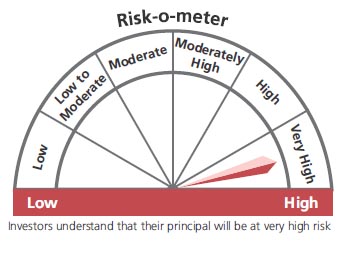

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Equity & Equity related Securities, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

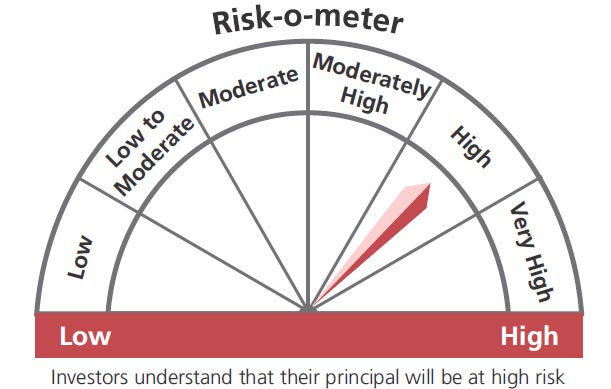

The above risk-o—meter is based on the scheme portfolio as on 30th June, 2024. An addendum may be issued or updated on the website for new riskometer.

^Mr. Arjun Khanna (Dedicated fund manager for investments in foreign securities).

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'