An open-ended equity scheme investing in Technology & technology related Sectors

An open-ended equity scheme investing in Technology & technology related Sectors

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of Technology & technology related sectors. However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of Technology & technology related sectors. However, there is no assurance that the objective of the scheme will be achieved.

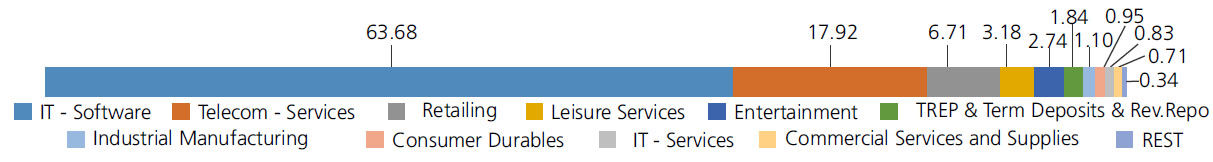

| Instrument/Industry/Issuer | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| IT - Software | 63.68 | |

| Infosys Ltd. | 22.75 | |

| Tata Consultancy Services Ltd. | 13.52 | |

| Tech Mahindra Ltd. | 6.79 | |

| HCL Technologies Ltd. | 5.66 | |

| Wipro Ltd. | 4.12 | |

| Persistent Systems Limited | 3.71 | |

| Mphasis Ltd | 2.92 | |

| Birlasoft Ltd. | 1.93 | |

| Zensar Technolgies Ltd. | 1.58 | |

| Sonata Software Ltd. | 0.70 | |

| Telecom - Services | 17.92 | |

| Bharti Airtel Ltd | 13.28 | |

| Bharti Hexacom Ltd. | 2.45 | |

| Indus Towers Ltd. | 1.43 | |

| Tata Communications Ltd. | 0.76 | |

| Retailing | 6.71 | |

| Zomato Ltd. | 4.04 | |

| Info Edge (India) Ltd. | 1.81 | |

| FSN E-Commerce Ventures Ltd. | 0.86 | |

| Leisure Services | 3.18 | |

| TBO TEK LIMITED | 3.18 | |

| Entertainment | 2.74 | |

| PVR Inox Limited | 1.45 | |

| Sun TV Network Ltd. | 1.29 | |

| Industrial Manufacturing | 1.10 | |

| Kaynes Technology India Ltd. | 1.10 | |

| Consumer Durables | 0.95 | |

| Dixon Technologies India Ltd. | 0.95 | |

| IT - Services | 0.83 | |

| Cyient Ltd. | 0.83 | |

| Commercial Services and Supplies | 0.71 | |

| Tracxn Technologies Ltd. | 0.71 | |

| Equity & Equity related - Total | 97.82 | |

| Triparty Repo | 1.84 | |

| Net Current Assets/(Liabilities) | 0.34 | |

| Grand Total | 100.00 | |

| | ||

| Regular | Direct | |

| Growth | Rs10.7300 | Rs10.7800 |

| IDCW | Rs10.7300 | Rs10.7800 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager*^ |

Ms. Shibani Sircar Kurian, Mr. Abhishek Bisen |

| Benchmark | BSE Teck Index (Total Return Index) |

| Allotment date | March 04, 2024 |

| AAUM | Rs348.82 crs |

| AUM | Rs363.71 crs |

| Folio count | 40,047 |

Trustee's Discretion

| Portfolio Turnover | 7.00% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 30

days from the date of allotment: 1%

• If units are redeemed or switched out on

or after 30 days from the date of allotment:

NIL.

| Regular Plan: | 2.43% |

| Direct Plan: | 1.00% |

Benchmark

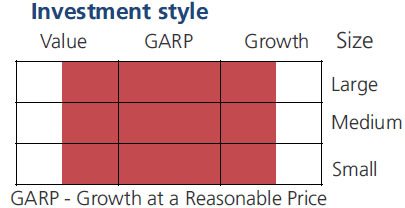

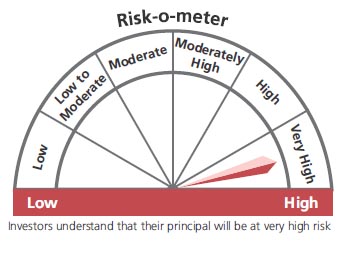

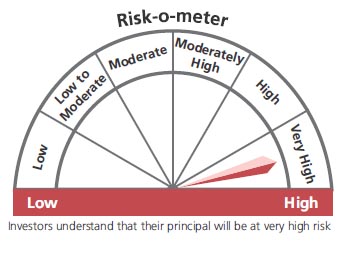

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment in portfolio of predominantly equity & equity related securities of Technology & Technology related sectors.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 30th June, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

Scheme has not completed 6 months since inception

* For Fund Manager experience, please refer 'Our Fund Managers'