An open ended equity scheme following business cycles based investing theme

An open ended equity scheme following business cycles based investing theme

The scheme shall seek to generate long

term capital appreciation by investing

predominantly in equity and equity related

securities with a focus on riding business

cycles through dynamic allocation between

various sectors and stocks at different

stages of business cycles in the economy.

However, there is no assurance that the

objective of the scheme will be realized.

The scheme shall seek to generate long

term capital appreciation by investing

predominantly in equity and equity related

securities with a focus on riding business

cycles through dynamic allocation between

various sectors and stocks at different

stages of business cycles in the economy.

However, there is no assurance that the

objective of the scheme will be realized.

| Instrument/Industry/Issuer | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

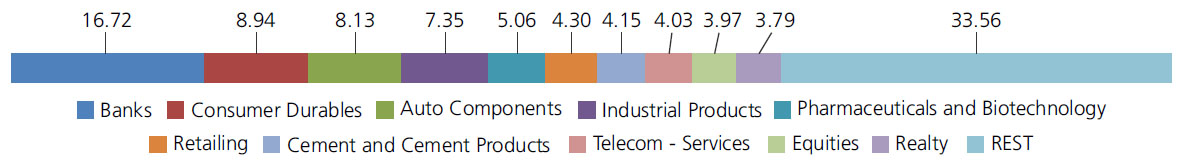

| Banks | 16.72 | |

| ICICI Bank Ltd. | 4.95 | |

| Axis Bank Ltd. | 3.94 | |

| HDFC Bank Ltd. | 3.86 | |

| IndusInd Bank Ltd. | 1.82 | |

| Indian Bank | 1.25 | |

| Kotak Mahindra Bank Ltd. | 0.90 | |

| Consumer Durables | 8.94 | |

| Century Plyboards (India) Ltd. | 2.48 | |

| Whirlpool of India Ltd. | 2.47 | |

| Blue Star Ltd. | 1.92 | |

| Kajaria Ceramics Ltd. | 1.33 | |

| Elin Electronics Ltd. | 0.74 | |

| Auto Components | 8.13 | |

| Bharat Forge Ltd. | 3.18 | |

| Uno Minda Limited | 2.22 | |

| Bosch Ltd. | 1.78 | |

| Sansera Engineering Ltd. | 0.49 | |

| Minda Corporation Limited | 0.46 | |

| Industrial Products | 7.35 | |

| Carborundum Universal Ltd. | 2.01 | |

| Cummins India Ltd. | 1.76 | |

| Happy Forgings Ltd | 1.37 | |

| SKF India Ltd | 1.30 | |

| Inox India Ltd | 0.91 | |

| Pharmaceuticals and Biotechnology | 5.06 | |

| Sun Pharmaceuticals Industries Ltd. | 2.33 | |

| Mankind Pharma Ltd | 2.07 | |

| Ipca Laboratories Ltd. | 0.66 | |

| Retailing | 4.30 | |

| Avenue Supermarts Ltd. | 2.32 | |

| Zomato Ltd. | 1.98 | |

| Cement and Cement Products | 4.15 | |

| Ultratech Cement Ltd. | 2.10 | |

| Ambuja Cements Ltd. | 2.05 | |

| Telecom - Services | 4.03 | |

| Bharti Hexacom Ltd. | 4.03 | |

| Finance | 3.97 | |

| Cholamandalam Investment and Finance Company Ltd. | 1.98 | |

| Bajaj Finance Ltd. | 1.34 | |

| Power Finance Corporation Ltd. | 0.65 | |

| Realty | 3.79 | |

| Oberoi Realty Ltd | 2.02 | |

| Mahindra Lifespace Developers Ltd | 1.77 | |

| IT - Software | 3.52 | |

| Infosys Ltd. | 2.43 | |

| Tech Mahindra Ltd. | 1.09 | |

| Personal Products | 3.41 | |

| Godrej Consumer Products Ltd. | 2.38 | |

| Dabur India Ltd. | 1.03 | |

| Automobiles | 3.11 | |

| Maruti Suzuki India Limited | 3.11 | |

| Insurance | 3.01 | |

| SBI Life Insurance Company Ltd | 1.90 | |

| Medi Assist Healthcare Services Limited | 1.11 | |

| Petroleum Products | 2.99 | |

| Reliance Industries Ltd. | 2.99 | |

| Construction | 2.46 | |

| Larsen And Toubro Ltd. | 2.46 | |

| Industrial Manufacturing | 2.09 | |

| Honeywell Automation India Ltd. | 2.09 | |

| Beverages | 1.68 | |

| United Spirits Ltd. | 1.68 | |

| Electrical Equipment | 1.66 | |

| Azad Engineering Ltd | 0.85 | |

| Thermax Ltd. | 0.81 | |

| Power | 1.59 | |

| National Thermal Power Corporation Limited | 1.59 | |

| Diversified FMCG | 1.46 | |

| ITC Ltd. | 1.46 | |

| Capital Markets | 1.32 | |

| Computer Age Management Services Limited | 1.32 | |

| Commercial Services and Supplies | 1.22 | |

| CMS Info Systems Ltd | 1.22 | |

| Transport Services | 1.00 | |

| Container Corporation of India Ltd. | 1.00 | |

| Leisure Services | 0.74 | |

| Tbo Tek Limited | 0.74 | |

| Equity & Equity related - Total | 97.70 | |

| Triparty Repo | 0.44 | |

| Net Current Assets/(Liabilities) | 1.86 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 1 year |

| Total amount invested (₹) | 2,10,000 | 1,20,000 |

| Total Value as on June 28, 2024 (₹) | 2,81,536 | 1,48,005 |

| Scheme Returns (%) | 36.34 | 46.69 |

| NIFTY 500 TRI (%) | 36.13 | 43.24 |

| Alpha* | 0.21 | 3.45 |

| NIFTY 500 TRI (₹) # | 2,81,113 | 1,46,039 |

| Nifty 50 (₹) ^ | 2,61,790 | 1,39,256 |

| Nifty 50 (%) | 26.54 | 31.54 |

| Regular | Direct | |

| Growth | Rs14.9230 | Rs15.3600 |

| IDCW | Rs14.9230 | Rs15.3590 |

A) Direct Plan B) Regular Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all

plans)

| Fund Manager*^ | Mr. Harish Bihani & Mr. Abhishek Bisen |

| Benchmark | Nifty 500 TRI |

| Allotment date | September 28, 2022 |

| AAUM | Rs2,583.60 crs |

| AUM | Rs2,616.08 crs |

| Folio count | 74,780 |

Trustee's Discretion

| Portfolio Turnover | 28.13% |

| (P/E) | 35.92 |

| P/BV | 5.21 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.93% |

| Direct Plan: | 0.45% |

Benchmark

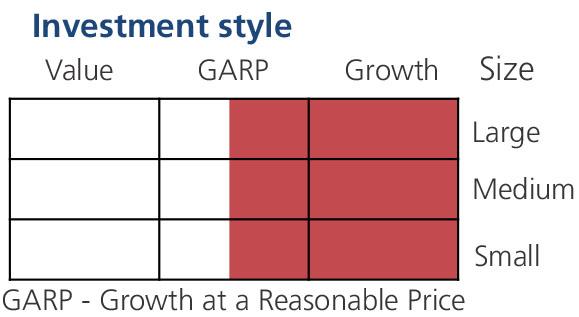

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in portfolio of predominantly equity & equity related securities of companies with a focus on riding business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy

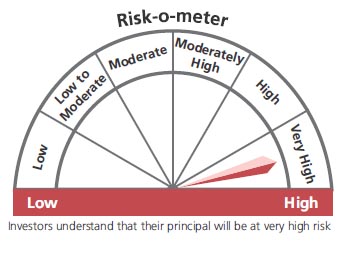

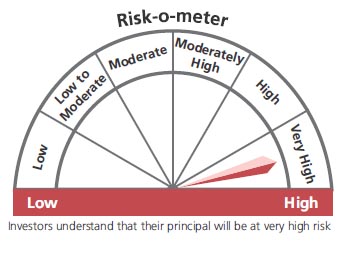

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 30th June, 2024. An addendum may be issued or updated on the website for new riskometer.

^Mr. Arjun Khanna (Dedicated fund manager for investments in foreign securities).

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'