The investment objective of the scheme is

to generate capital appreciation from a

diversified portfolio of equity, equity related

instruments and units of global mutual

funds which invests into such companies

that utilize new forms of production,

technology, distribution or processes which

are likely to challenge existing markets or

value networks, or displace established

market leaders, or bring in novel products

and/or business models.

However, there can be no assurance that

the investment objective of the Scheme will

be realized.

The investment objective of the scheme is

to generate capital appreciation from a

diversified portfolio of equity, equity related

instruments and units of global mutual

funds which invests into such companies

that utilize new forms of production,

technology, distribution or processes which

are likely to challenge existing markets or

value networks, or displace established

market leaders, or bring in novel products

and/or business models.

However, there can be no assurance that

the investment objective of the Scheme will

be realized.

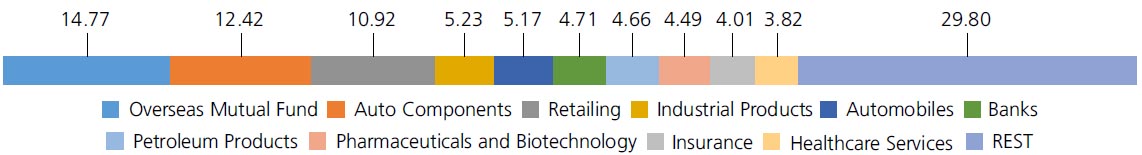

| Issuer/Instrument | Rating | % to Net Assets |

|

|---|---|---|---|

| Equity & Equity related

|

|||

| Auto Components | 12.42 | ||

| Uno Minda Limited | 2.91 | ||

| Bharat Forge Ltd. | 2.77 | ||

| Samvardhana Motherson International Limited | 2.22 | ||

| Rolex Rings Ltd. | 1.84 | ||

| Schaeffler India Ltd | 1.43 | ||

| Minda Corporation Limited | 1.25 | ||

| Retailing | 10.92 | ||

| Zomato Ltd. | 4.14 | ||

| Trent Ltd | 2.37 | ||

| Avenue Supermarts Ltd. | 2.17 | ||

| Info Edge (India) Ltd. | 1.13 | ||

| Brainbees Solutions Limited | 1.11 | ||

| Industrial Products | 5.23 | ||

| AIA Engineering Limited. | 1.82 | ||

| Ratnamani Metals & Tubes Ltd. | 1.21 | ||

| Carborundum Universal Ltd. | 1.14 | ||

| Happy Forgings Ltd | 1.06 | ||

| Automobiles | 5.17 | ||

| Maruti Suzuki India Limited | 3.83 | ||

| Mahindra & Mahindra Ltd. | 1.34 | ||

| Banks | 4.71 | ||

| HDFC Bank Ltd. | 2.86 | ||

| ICICI Bank Ltd. | 1.85 | ||

| Petroleum Products | 4.66 | ||

| Reliance Industries Ltd. | 4.66 | ||

| Pharmaceuticals and Biotechnology | 4.49 | ||

| Sun Pharmaceuticals Industries Ltd. | 2.61 | ||

| Mankind Pharma Ltd | 1.88 | ||

| Insurance | 4.01 | ||

| SBI Life Insurance Company Ltd | 2.04 | ||

| ICICI Lombard General Insurance Company Ltd | 1.97 | ||

| Healthcare Services | 3.82 | ||

| Krishna Institute Of Medical Sciences Ltd. | 1.85 | ||

| Aster DM Healthcare Ltd | 1.33 | ||

| Syngene International Limited | 0.64 | ||

| Electrical Equipment | 3.48 | ||

| ABB India Ltd | 2.26 | ||

| Thermax Ltd. | 1.22 | ||

| Transport Services | 3.24 | ||

| Inter Globe Aviation Ltd | 3.24 | ||

| IT - Software | 3.22 | ||

| Persistent Systems Limited | 3.22 | ||

| Telecom - Services | 3.13 | ||

| Bharti Hexacom Ltd. | 3.13 | ||

| Finance | 2.43 | ||

| Bajaj Finance Ltd. | 2.43 | ||

| Consumer Durables | 2.23 | ||

| Titan Company Ltd. | 2.23 | ||

| Financial Technology (Fintech) | 1.67 | ||

| PB Fintech Ltd. | 1.67 | ||

| Commercial Services and Supplies | 1.57 | ||

| CMS Info Systems Ltd | 1.14 | ||

| Tracxn Technologies Ltd. | 0.43 | ||

| Chemicals and Petrochemicals | 1.36 | ||

| Solar Industries India Limited | 1.36 | ||

| Realty | 1.25 | ||

| Mahindra Lifespace Developers Ltd | 1.25 | ||

| IT - Services | 1.23 | ||

| Cyient Ltd. | 1.23 | ||

| Leisure Services | 1.12 | ||

| TBO TEK Limited | 1.12 | ||

| Fertilizers and Agrochemicals | 0.98 | ||

| P I Industries Ltd | 0.98 | ||

| Diversified | 0.92 | ||

| 3M India Ltd. | 0.92 | ||

| Personal Products | 0.52 | ||

| Godrej Consumer Products Ltd. | 0.52 | ||

| Equity & Equity related - Total | 83.78 | ||

| Mutual Fund Units | |||

| Ishares Nasdaq 100 UCITS ETF USD - for Domestic schemes | Overseas Mutual Fund | 14.77 | |

| Mutual Fund Units - Total | 14.77 | ||

| Triparty Repo | 1.54 | ||

| Net Current Assets/(Liabilities) | -0.09 | ||

| Grand Total | 100.00 | ||

| | |||

For viewing detailed portfolio of CI Global Alpha Innovators Corporate Class on desktop please visit: www.kotakmf.com>> Forms &

Downloads>>Portfolios>>CI Global Alpha Innovators Corporate Class.

| Monthly SIP of (Rs) 10000 | Since Inception | 3 years | 1 year |

| Total amount invested (₹) | 5,90,000 | 3,60,000 | 1,20,000 |

| Total Value as on Aug 30, 2024 (₹) | 11,77,409 | 5,60,173 | 1,51,294 |

| Scheme Returns (%) | 28.62 | 30.97 | 51.85 |

| 85% Nifty 500 TRI + 15% MSCI ACWI Information Technology Index | 26.09 | 27.89 | 43.29 |

| Alpha* | 2.54 | 3.08 | 8.56 |

| 85% Nifty 500 TRI + 15% MSCI ACWI Information Technology Index (₹)# | 11,09,736 | 5,37,609 | 1,46,375 |

| Nifty 50 (TRI) (₹)^ | 9,97,445 | 4,93,730 | 1,41,155 |

| Nifty 50 (TRI) Returns (%) | 21.56 | 21.66 | 34.36 |

| Regular | Direct | |

| Growth | Rs30.5056 | Rs32.9866 |

| IDCW | Rs30.5194 | Rs32.9817 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager*^ : | Mr. Harish Bihani

|

| Benchmark | 85% Nifty 500 TRI+15% MSCI ACWI Information Technology Index TRI |

| Allotment date | October 31, 2019 |

| AAUM | Rs2,641.39 crs |

| AUM | Rs2,719.66 crs |

| Folio count | 69,806 |

Trustee's Discretion

| Portfolio Turnover | 35.26% |

| $Beta | 0.91 |

| $Sharpe ## | 0.90 |

| $Standard Deviation | 13.17% |

| (P/E) | 46.97 |

| P/BV | 7.02 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil.(applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.89% |

| Direct Plan: | 0.49% |

Folio count data as on 31st July 2024.

Benchmark

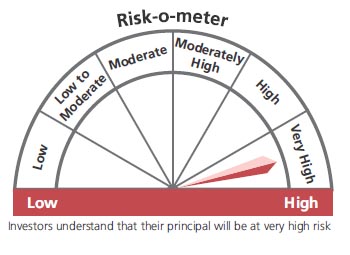

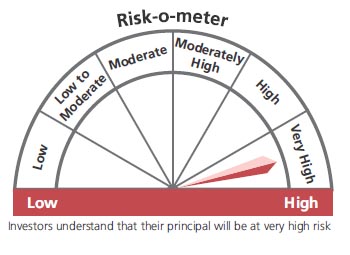

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity and equity related securities of companies operating with pioneering innovations theme without any market capitalisation and sector bias.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st July, 2024. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 6.80% (FBIL Overnight MIBOR rate as on 30th Aug 2024). **Total Expense Ratio includes applicable B30 fee and GST.

^Mr. Arjun Khanna (Dedicated fund manager for investments in foreign securities).

For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'