An open ended debt scheme investing in government securities across maturity.

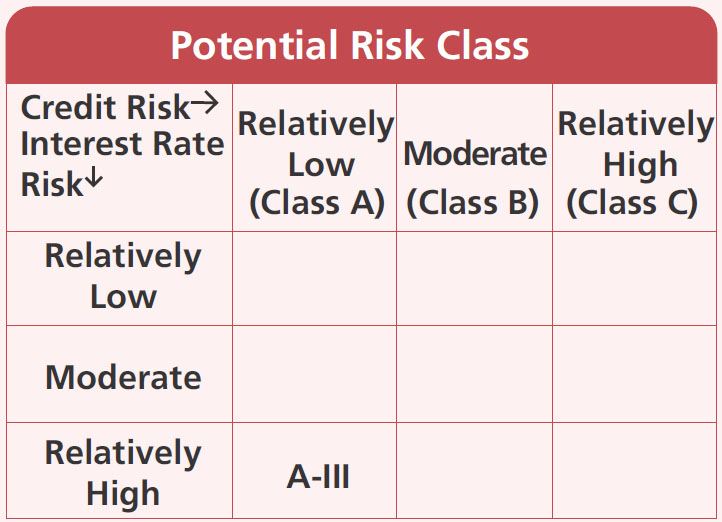

A relatively high interest rate risk and relatively low credit risk.

An open ended debt scheme investing in government securities across maturity.

A relatively high interest rate risk and relatively low credit risk.

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Government Dated Securities | ||

| 7.30% Central Government | SOV | 26.35 |

| 7.25% Central Government | SOV | 21.96 |

| 7.46% Central Government | SOV | 11.62 |

| 7.34% Central Government | SOV | 10.91 |

| 7.18% Central Government(^) | SOV | 9.46 |

| 7.09% Central Government | SOV | 6.59 |

| 6.80% Central Government | SOV | 5.59 |

| 7.32% Central Government | SOV | 0.84 |

| 7.02% Central Government | SOV | 0.73 |

| 7.38% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.65 |

| 7.70% Maharashtra State Govt-Maharashtra | SOV | 0.45 |

| 7.95% Central Government | SOV | 0.33 |

| 7.42% Karnataka State Govt-Karnataka | SOV | 0.32 |

| 8.28% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.20 |

| 8.37% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.14 |

| 7.18% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.14 |

| GS CG 23/12/2025 - (STRIPS) | SOV | 0.08 |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.08 |

| 7.84% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.08 |

| 7.26% Central Government | SOV | 0.08 |

| 7.91% Uttar Pradesh State Govt-Uttar Pradesh | SOV | 0.07 |

| 6.57% Andhra Pradesh State Govt-Andhra Pradesh | SOV | 0.07 |

| 8.39% Uttar Pradesh State Govt-Uttar Pradesh | SOV | 0.06 |

| 8.08% Maharashtra State Govt-Maharashtra | SOV | 0.06 |

| 7.80% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.04 |

| 6.68% Haryana State Govt-Haryana | SOV | 0.04 |

| 7.68% Karnataka State Govt-Karnataka | SOV | 0.03 |

| 6.78% Karnataka State Govt-Karnataka | SOV | 0.03 |

| 8.16% Gujarat State Govt-Gujarat | SOV | 0.01 |

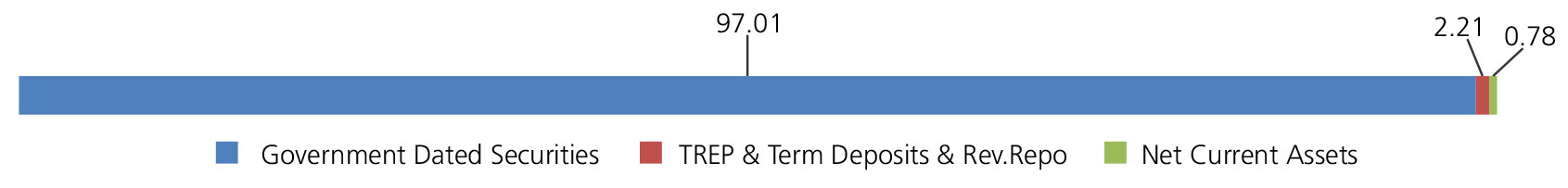

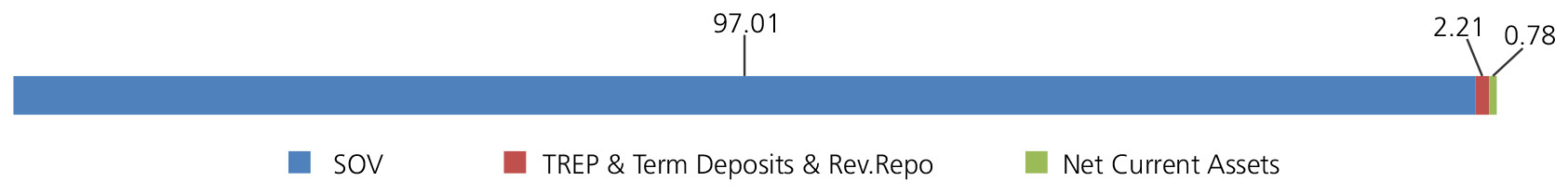

| Government Dated Securities - Total | 97.01 | |

| Triparty Repo | 2.21 | |

| Net Current Assets/(Liabilities) | 0.78 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 30,90,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on August 30, 2024 (₹) | 98,83,274 | 17,18,150 | 10,70,068 | 7,03,787 | 4,02,065 | 1,26,221 |

| Scheme Returns (%) | 8.06 | 6.98 | 6.81 | 6.32 | 7.32 | 9.79 |

| Nifty All Duration G-Sec Index Returns (%) | NA | 7.38 | 7.36 | 6.93 | 8.32 | 11.10 |

| Alpha* | NA | -0.41 | -0.54 | -0.61 | -1.01 | -1.32 |

| Nifty All Duration G-Sec Index (₹)# | NA | 17,55,045 | 10,90,997 | 7,14,548 | 4,08,088 | 1,27,044 |

| CRISIL 10 Year Gilt Index (₹)^ | NA | 16,49,326 | 10,43,853 | 6,94,502 | 4,03,520 | 1,26,608 |

| CRISIL 10 Year Gilt Index Returns (%) | NA | 6.20 | 6.12 | 5.79 | 7.56 | 10.40 |

| Regular | Direct | Quarterly | |

| Growth | Rs91.43 | Rs102.89 | |

| Quarterly IDCW | Rs17.87 | Rs23.24 | |

| PF&Trust | Rs93.54 | Rs105.38 | Rs12.02 |

A) Regular Non Direct Plan,

B) PF & Trust Non Direct Plan,

C) Regular Direct Plan,

D) PF & Trust Direct Plan.

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager*^ | Mr. Abhishek Bisen |

| Benchmark | Nifty All Duration G-Sec Index |

| Allotment date | Regular Plan - December 29, 1998; PF & Trust Plan - November 11, 2003 |

| AAUM | Rs3,415.52 crs |

| AUM | Rs3,643.14 crs |

| Folio count | 9,284 |

Quarterly (20th of Mar/Jun/Sep/Dec)

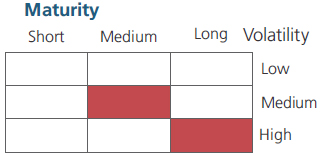

| Average Maturity | 31.73 yrs |

| Modified Duration | 11.54 yrs |

| Macaulay Duration | 11.94 yrs |

| Annualised YTM* | 7.12% |

| $Standard Deviation | 2.38% |

Source: $ICRA MFI Explorer.

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 2 years & above

Entry Load:

(a) Regular Plan - Entry: Nil.

(b) PF & Trust Plan - Entry: Nil. (applicable

for all plans)

Exit Load: (a) Regular Plan - Exit: Nil. (b)

PF&Trust Plan-Exit: Nil. (applicable for all

plans)

| Regular Plan: | 1.48% |

| Direct Plan: | 0.47% |

Folio count data as on 31st July 2024.

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Income over a long investment horizon

- Investment in sovereign securities issued by the Central and/or State Government(s) and/or reverse repos in such securities

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st July, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'