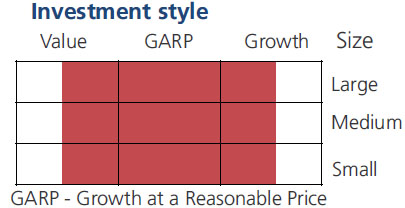

An open-ended equity scheme following special situations theme

An open-ended equity scheme following special situations theme

The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in opportunities presented by Special Situations such as Company Specific Event/Developments, Corporate Restructuring, Government Policy change and/or Regulatory changes, Technology led Disruption/ Innovation or companies going through temporary but unique challenges and other similar instances. However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in opportunities presented by Special Situations such as Company Specific Event/Developments, Corporate Restructuring, Government Policy change and/or Regulatory changes, Technology led Disruption/ Innovation or companies going through temporary but unique challenges and other similar instances. However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

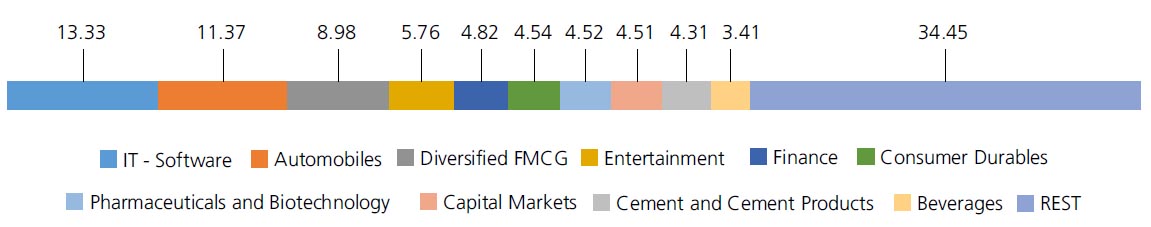

| IT - Software | 13.33 | |

| Oracle Financial Services Software Ltd | 4.60 | |

| Wipro Ltd. | 3.60 | |

| Tech Mahindra Ltd. | 2.73 | |

| Mphasis Ltd | 2.40 | |

| Automobiles | 11.37 | |

| Maruti Suzuki India Limited | 6.62 | |

| Hero MotoCorp Ltd. | 4.75 | |

| Diversified FMCG | 8.98 | |

| ITC Ltd. | 4.76 | |

| Hindustan Unilever Ltd. | 4.22 | |

| Entertainment | 5.76 | |

| PVR Inox Limited | 3.02 | |

| Sun TV Network Ltd. | 2.74 | |

| Finance | 4.82 | |

| LIC Housing Finance Ltd. | 2.72 | |

| Poonawalla Fincorp Ltd. | 2.10 | |

| Consumer Durables | 4.54 | |

| Crompton Greaves Consumer Electricals Ltd | 2.59 | |

| Bata India Ltd. | 1.95 | |

| Pharmaceuticals and Biotechnology | 4.52 | |

| Marksans Pharma Ltd | 2.79 | |

| Jubilant Pharmova Limited | 1.73 | |

| Capital Markets | 4.51 | |

| UTI Asset Management Company Ltd | 2.39 | |

| Aditya Birla Sun Life AMC Ltd | 2.12 | |

| Cement and Cement Products | 4.31 | |

| Orient Cement Limited | 2.55 | |

| Kesoram Industries Limited | 1.76 | |

| Beverages | 3.41 | |

| Radico Khaitan Ltd. | 3.41 | |

| Industrial Manufacturing | 3.15 | |

| Jyoti CNC Automation Ltd | 3.15 | |

| Personal Products | 3.07 | |

| Dabur India Ltd. | 3.07 | |

| Power | 2.88 | |

| NLC India Ltd. | 2.88 | |

| Auto Components | 2.77 | |

| Samvardhana Motherson International Limited | 2.77 | |

| Telecom - Services | 2.66 | |

| Indus Towers Ltd. | 2.66 | |

| Leisure Services | 2.12 | |

| Sapphire Foods India Ltd. | 2.12 | |

| Gas | 2.04 | |

| Gujarat State Petronet Ltd. | 2.04 | |

| Aerospace and Defense | 2.00 | |

| Astra Microwave Products Ltd. | 2.00 | |

| Industrial Products | 1.65 | |

| Carborundum Universal Ltd. | 1.65 | |

| Fertilizers and Agrochemicals | 1.62 | |

| Coromandel International Ltd. | 1.62 | |

| Construction | 1.57 | |

| Kalpataru Projects International Limited | 1.57 | |

| Retailing | 1.55 | |

| Brainbees Solutions Limited | 1.55 | |

| Electrical Equipment | 1.45 | |

| Azad Engineering Ltd | 1.45 | |

| Transport Services | 1.33 | |

| Mahindra Logistics Ltd | 1.33 | |

| Chemicals and Petrochemicals | 1.07 | |

| SRF Ltd. | 1.07 | |

| Healthcare Services | 1.06 | |

| Aster DM Healthcare Ltd | 1.06 | |

| Equity & Equity related - Total | 97.54 | |

| Mutual Fund Units | ||

| Kotak Liquid Direct Growth | 1.26 | |

| Mutual Fund Units - Total | 1.26 | |

| Triparty Repo | 1.37 | |

| Net Current Assets/(Liabilities) | -0.17 | |

| Grand Total | 100.00 | |

| | ||

| Regular | Direct | |

| Growth | Rs10.3574 | Rs10.3820 |

| IDCW | Rs10.3574 | Rs10.3819 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager*^ |

Mr. Devender Singhal, Mr. Arjun Khanna & Mr. Abhishek Bisen |

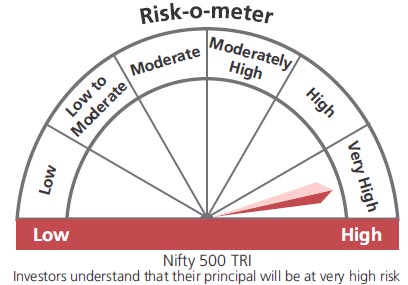

| Benchmark | Nifty 500 Total Return Index |

| Allotment date | July 25, 2024 |

| AAUM | Rs2,327.04 crs |

| AUM | Rs2,394.67 crs |

| Folio count | 1,09,182 |

Trustee's Discretion

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto

10% of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

| Regular Plan: | 1.99% |

| Direct Plan: | 0.62% |

Folio count data as on 31st July 2024.

Benchmark

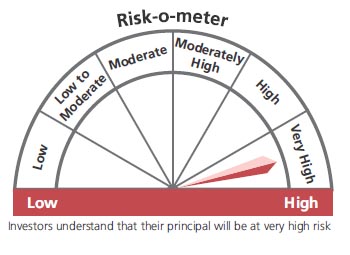

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment in portfolio of predominantly equity & equity related securities following Special Situation Theme.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st July, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

Scheme has not completed 6 months since inception

* For Fund Manager experience, please refer 'Our Fund Managers'