An open ended equity scheme following manufacturing theme

An open ended equity scheme following manufacturing theme

The scheme shall seek to generate capital appreciation by investing in a diversified portfolio of companies that follow the manufacturing theme. However, there is no assurance that the objective of the Scheme will be realized.

The scheme shall seek to generate capital appreciation by investing in a diversified portfolio of companies that follow the manufacturing theme. However, there is no assurance that the objective of the Scheme will be realized.

| Issuer/Instrument | % to Net Assets |

|

|---|---|---|

| Equity & Equity related |

||

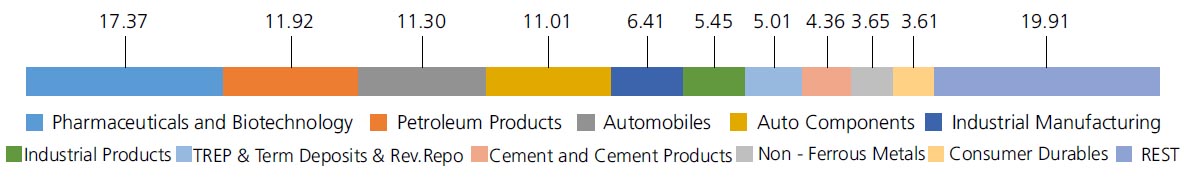

| Pharmaceuticals and Biotechnology | 17.37 | |

| Sun Pharmaceuticals Industries Ltd. | 5.06 | |

| Dr Reddys Laboratories Ltd. | 2.93 | |

| Zydus Lifesciences Limited | 2.53 | |

| Biocon Ltd. | 2.28 | |

| Cipla Ltd. | 2.10 | |

| GlaxoSmithKline Pharmaceuticals Ltd. | 1.09 | |

| Emcure Pharmaceuticals Limited | 0.83 | |

| Ipca Laboratories Ltd. | 0.55 | |

| Petroleum Products | 11.92 | |

| Reliance Industries Ltd. | 4.49 | |

| Bharat Petroleum Corporation Ltd. | 2.84 | |

| Hindustan Petroleum Corporation Ltd | 2.83 | |

| Indian Oil Corporation Ltd | 1.76 | |

| Automobiles | 11.30 | |

| Tata Motors Ltd. | 2.98 | |

| Hero MotoCorp Ltd. | 2.92 | |

| Maruti Suzuki India Limited | 1.97 | |

| Mahindra & Mahindra Ltd. | 1.95 | |

| Eicher Motors Ltd. | 1.48 | |

| Auto Components | 11.01 | |

| Bosch Ltd. | 2.19 | |

| Bharat Forge Ltd. | 1.92 | |

| Samvardhana Motherson International Limited | 1.78 | |

| Exide Industries Ltd | 1.56 | |

| Sansera Engineering Ltd. | 1.35 | |

| Apollo Tyres Ltd. | 0.92 | |

| Schaeffler India Ltd | 0.89 | |

| JK Tyre & Industries Ltd. | 0.40 | |

| Industrial Manufacturing | 6.41 | |

| Dee Development Engineeers Ltd | 1.99 | |

| Kaynes Technology India Ltd. | 1.99 | |

| Jyoti CNC Automation Ltd | 1.25 | |

| JNK India Limited | 1.11 | |

| Honeywell Automation India Ltd. | 0.07 | |

| Industrial Products | 5.45 | |

| Cummins India Ltd. | 2.04 | |

| Carborundum Universal Ltd. | 1.75 | |

| AIA Engineering Limited. | 1.23 | |

| Happy Forgings Ltd | 0.43 | |

| Cement and Cement Products | 4.36 | |

| Ambuja Cements Ltd. | 2.45 | |

| Ultratech Cement Ltd. | 1.91 | |

| Non - Ferrous Metals | 3.65 | |

| Hindalco Industries Ltd | 2.78 | |

| National Aluminium Company Ltd | 0.87 | |

| Consumer Durables | 3.61 | |

| Voltas Ltd. | 1.35 | |

| V-Guard Industries Ltd. | 1.18 | |

| Amber Enterprises India Ltd. | 0.71 | |

| Cello World Ltd. | 0.21 | |

| Dixon Technologies India Ltd. | 0.16 | |

| Electrical Equipment | 3.57 | |

| ABB India Ltd | 2.44 | |

| Thermax Ltd. | 1.13 | |

| Ferrous Metals | 3.33 | |

| Tata Steel Ltd. | 3.33 | |

| Construction | 2.46 | |

| Larsen And Toubro Ltd. | 2.46 | |

| Fertilizers and Agrochemicals | 2.44 | |

| Coromandel International Ltd. | 2.44 | |

| Chemicals and Petrochemicals | 2.42 | |

| Solar Industries India Limited | 1.13 | |

| SRF Ltd. | 0.81 | |

| Tata Chemicals Ltd | 0.48 | |

| Aerospace and Defense | 2.41 | |

| Bharat Electronics Ltd. | 2.41 | |

| Personal Products | 1.26 | |

| Godrej Consumer Products Ltd. | 1.26 | |

| Diversified | 0.78 | |

| 3M India Ltd. | 0.78 | |

| Textiles and Apparels | 0.55 | |

| Garware Technical Fibres Ltd. | 0.55 | |

| Capital Markets | 0.47 | |

| Premier Energies Limited | 0.47 | |

| Equity & Equity related - Total | 94.77 | |

| Mutual Fund Units | ||

| Kotak Liquid Direct Growth | 0.33 | |

| Mutual Fund Units - Total | 0.33 | |

| Triparty Repo | 5.01 | |

| Net Current Assets/(Liabilities) | -0.11 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 1 year |

| Total amount invested (₹) | 3,10,000 | 1,20,000 |

| Total Value as on Aug 30, 2024 (₹) | 4,44,376 | 1,41,899 |

| Scheme Returns (%) | 29.36 | 35.63 |

| NIFTY INDIA MANUFACTURING TRI (%) | 42.62 | 62.79 |

| Alpha* | -13.26 | -27.17 |

| NIFTY INDIA MANUFACTURING TRI (₹)# | 5,14,214 | 1,57,468 |

| Nifty 50 (₹)^ | 4,19,608 | 1,41,155 |

| Nifty 50 (%) | 24.37 | 34.36 |

| Regular | Direct | |

| Growth | Rs19.2950 | Rs20.1096 |

| IDCW | Rs19.2948 | Rs20.1095 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution cum

capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* | Mr. Harsha Upadhyaya & Mr. Abhishek Bisen |

| Benchmark | Nifty India Manufacturing Index TRI |

| Allotment date | February 22, 2022 |

| AAUM | Rs2,458.66 crs |

| AUM | Rs2,520.00 crs |

| Folio count | 83,019 |

Trustee's Discretion

| Portfolio Turnover | 19.03% |

| $Beta | 0.79 |

| $Sharpe ## | 1.68 |

| $Standard Deviation | 11.83% |

| (P/E) | 27.20 |

| P/BV | 4.35 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Units issued on reinvestment of IDCW shall

not be subject to entry and exit load.

| Regular Plan: | 1.95% |

| Direct Plan: | 0.46% |

Folio count data as on 31st July 2024.

Benchmark

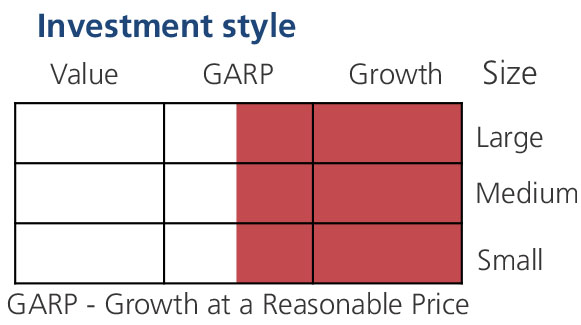

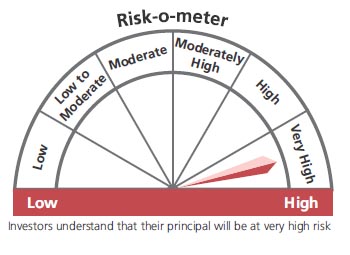

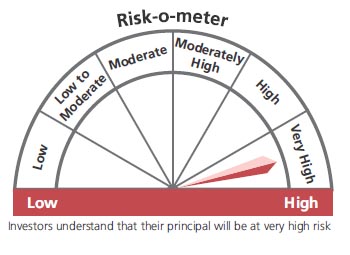

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment equity and equity related securities across market capitalisation.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st July, 2024. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 6.80% (FBIL Overnight MIBOR rate as on 30th Aug 2024). **Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'