An open ended fund of fund investing in units of Wellington Global Innovation Fund or any other similar overseas mutual fund schemes/ETFs

An open ended fund of fund investing in units of Wellington Global Innovation Fund or any other similar overseas mutual fund schemes/ETFs

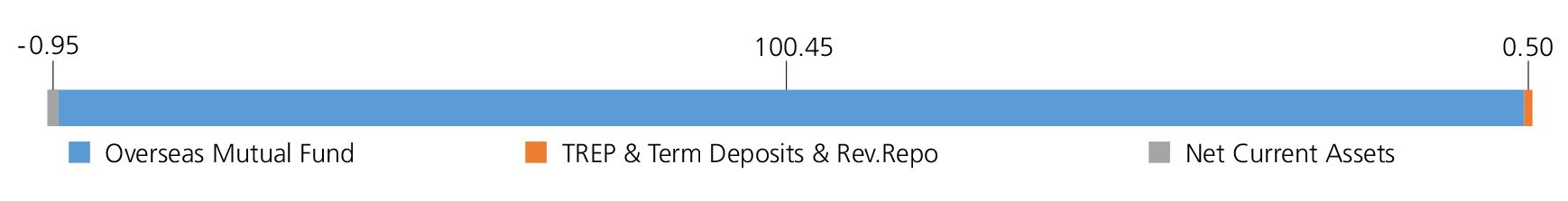

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Wellington Global Innovation S USD ACC | Overseas Mutual Fund | 100.45 |

| Mutual Fund Units - Total | 100.45 | |

| Triparty Repo | 0.50 | |

| Net Current Assets/(Liabilities) | -0.95 | |

| Grand Total | 100.00 | |

| Monthly SIP of ₹ 10000 | Since Inception | 3 years | 1 year |

| Total amount invested (₹) | 3,80,000 | 3,60,000 | 1,20,000 |

| Total Value as on August 30, 2024 (₹) | 4,69,064 | 4,49,062 | 1,37,356 |

| Scheme Returns (%) | 13.42 | 14.91 | 27.97 |

| MSCI AC World TRI (%) | 17.53 | 18.39 | 30.74 |

| Alpha* | -4.11 | -3.48 | -2.77 |

| MSCI AC World TRI (₹)# | 4,98,986 | 4,71,741 | 1,39,010 |

| Nifty 50 TRI (₹)^ | 5,26,491 | 4,93,866 | 1,41,155 |

| Nifty 50 TRI (%) | 21.15 | 21.67 | 34.36 |

| Regular | Direct | |

| Growth | Rs10.0129 | Rs10.4011 |

| IDCW | Rs10.0131 | Rs10.4005 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Arjun Khanna |

| Benchmark | MSCI AC World TRI |

| Allotment date | July 29, 2021 |

| AAUM | Rs748.76 crs |

| AUM | Rs744.07 crs |

| Folio count | 41,565 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load: a) For redemptions or switched out within 1

year from the date of allotment of units,

irrespective of the amount of investment-

1.00%

b) For redemptions or switched out after 1

year from the date of allotment of units,

irrespective of the amount of investment-

NIL

| Regular Plan: | 1.58% |

| Direct Plan: | 0.45% |

Folio count data as on 31st July 2024.

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in units of Wellington Global Innovation Fund or any other similar overseas mutual fund schemes/ETFs.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st July, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'