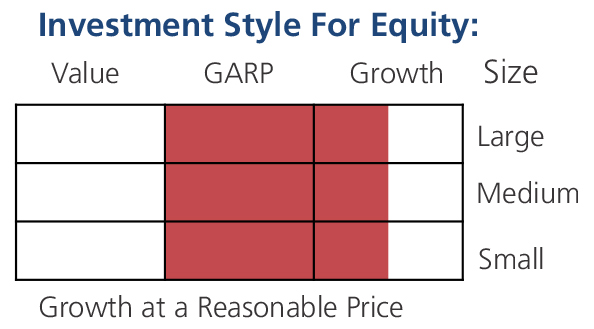

An open ended fund of fund scheme investing in units of Kotak Mahindra Mutual Fund schemes & ETFs / Index schemes (Domestic & Offshore Funds including Gold ETFs schemes).

An open ended fund of fund scheme investing in units of Kotak Mahindra Mutual Fund schemes & ETFs / Index schemes (Domestic & Offshore Funds including Gold ETFs schemes).

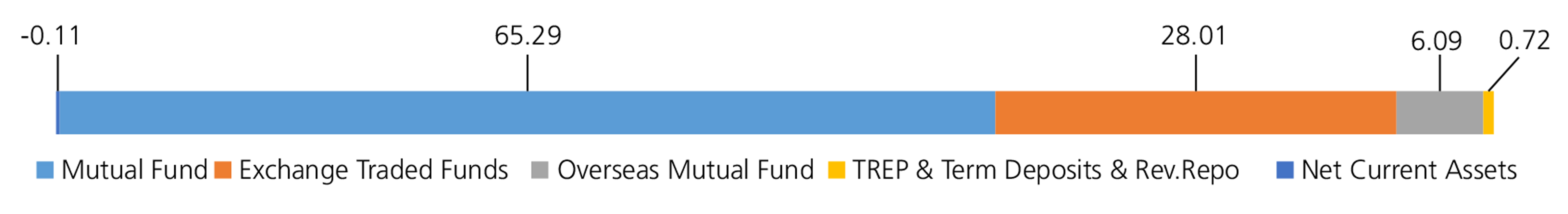

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Kotak Mutual Fund - Kotak Gold ETF | Exchange Traded Funds | 14.88 |

| Kotak Gilt Fund Direct Growth | Mutual Fund | 12.61 |

| Kotak Bond Direct Plan Growth | Mutual Fund | 10.90 |

| Kotak Consumption Fund Growth | Mutual Fund | 10.24 |

| Kotak Infrastructure & Economic Reform Fund Direct Growth | Mutual Fund | 9.63 |

| Kotak Quant Fund Growth | Mutual Fund | 7.19 |

| Ishares Nasdaq 100 UCITS ETF USD | Overseas Mutual Fund | 6.09 |

| Kotak Manufacture In India Fund | Mutual Fund | 5.26 |

| Kotak India EQ Contra Fund Direct Growth | Mutual Fund | 5.13 |

| Kotak Psu Bank ETF | Exchange Traded Funds | 5.05 |

| Kotak Mutual Fund- Kotak Liquid ETF | Exchange Traded Funds | 4.46 |

| Kotak Technology Fund Growth | Mutual Fund | 4.33 |

| Kotak Nifty IT ETF | Exchange Traded Funds | 3.62 |

| Mutual Fund Units - Total | 99.39 | |

| Triparty Repo | 0.72 | |

| Net Current Assets/(Liabilities) | -0.11 | |

| Grand Total | 100.00 | |

| Monthly SIP of Rs 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 24,10,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on August 30, 2024 (₹) | 1,35,38,217 | 30,29,159 | 17,57,566 | 10,70,409 | 5,13,758 | 1,39,438 |

| Scheme Returns (%) | 15.06 | 17.63 | 20.73 | 23.38 | 24.55 | 31.46 |

| 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold +5 %MSCI World Index (%) | NA | 12.58 | 13.58 | 14.45 | 15.04 | 22.06 |

| Alpha* | NA | 5.05 | 7.16 | 8.93 | 9.50 | 9.41 |

| 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold +5 % MSCI World Index(₹)# | NA | 23,09,960 | 13,62,197 | 8,61,310 | 4,49,894 | 1,33,788 |

| Nifty 50 TRI (₹)^ | 1,22,09,811 | 28,26,905 | 16,26,026 | 10,24,065 | 4,93,730 | 1,41,155 |

| Nifty 50 TRI Returns (%) | 14.22 | 16.35 | 18.54 | 21.55 | 21.66 | 34.36 |

# Benchmark; ^ Additional Benchmark. Alpha is difference of scheme return with benchmark return.

*All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer.

| Regular | Direct | |

| Growth | Rs221.8464 | Rs237.3268 |

| IDCW | Rs215.9464 | Rs233.0564 |

A)Regular Plan B)Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager*^ | Mr. Devender Singhal,

Mr. Abhishek Bisen |

| Benchmark | 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold +5 % MSCI World Index |

| Allotment date | August 9, 2004 |

| AAUM | Rs1,541.02 crs |

| AUM | Rs1,571.97 crs |

| Folio count | 35,557 |

Trustee's Discretion

| Portfolio Turnover | 43.75% |

| $Beta | 1.21 |

| $Sharpe ## | 1.27 |

| $Standard Deviation | 8.36% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load: 8% of the units allotted shall

be redeemed without any Exit Load on or

before completion of 1 Year from the date

of allotment of units. Any redemption in

excess of such limit within 1 Year from the

date of allotment shall be subject to the

following Exit Load:

a) If redeemed or switched out on or before

completion of 1 Year from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 1 Year from the date of

allotment of units-NIL

| Regular Plan: | 0.98% |

| Direct Plan: | 0.30% |

Folio count data as on 31st July 2024.

Fund

Benchmark

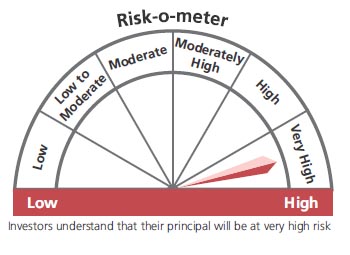

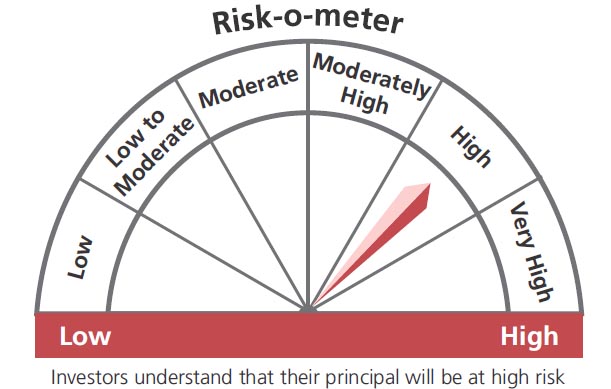

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in Kotak Mahindra Mutual Fund schemes & ETFs/Index schemes (Domestic & Offshore Funds including Gold ETFs)

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st July, 2024. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 6.80% (FBIL Overnight MIBOR rate as on 30th Aug 2024).

**Total Expense Ratio includes applicable B30 fee and GST.

^Mr. Arjun Khanna (Dedicated fund manager for investments in foreign securities).

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'